And lo the dumb banker bonus chat has begun with a Barclays CEO interview:

Q. Bonuses are up even though profits are down, aren't bonuses were supposed to be profit related?

A. Yes, well in those specific businesses/departments/teams where profits are down, so are bonuses. But, you have also to bear in mind we compete for expert labour from Singapore to San Francisco, so need to be able to pay competitive wages (i.e. bonuses might also be up in areas where profits are down)

And that's kind of it it would appear, except it's not. In the same way government austerity measures and the associated double digit hacking back of capital spending on flood defenses are for whatever reason only barely being linked to the current floods, so the ongoing run of investment bank shenanigans isn't being linked to investment bank bonuses.

But it should be. To give some very practical examples due to the various libor, Euribor, ForEx and what not investigations swathes of big bonus investment bank traders have been variously resigned, put on garden leave and sacked. And going by the we need to pay competitive wages to get the best people argument, there's presumably been a spike in pay for unbent libor traders, which are now in even shorter supply - from Singapore to San Francisco even - than they previously were. Or mebbe there's not given the actual number of people trying to get jobs in investment banks plus all those getting laid off elsewhere!

Plus, to what extent has replacing all the dodgy blerks with lovely compliant ones impacted the profitability of the libor, Euribor, ForEx trading departments? This would be nice to know given it would provide a start for assessing how big a share of investment bank profits were due to fraud and how much technical skill/luck (i.e. for any criminal fraud and proceeds of crime action, which you'd normally see if people other than highly paid bankers were involved).

I'm not holding my breath given the SFO's initial response to libor was to debate whether what was obviously a fraud was actually a fraud. In the meantime here's the lovely multi-million pound bonus story of Tom Hayes to keep you warm. What do you reckon he'll get - suspended sentence, not guilty or community service?

Wednesday, 12 February 2014

The nuclear option

So George Osborne, sources are letting it be known, will rule out the notion of a formal currency union with an independent Scotland? Interesting negotiating position if you're an utter walloper (1).

In that case, when Scotland hopefully votes yes to independence, the Scottish approach to relocating the Rest of the UK's nuclear bombs will presumably be; your problem pal, pick 'em up next Tuesday and F'right off in the meantime. Or not.

Actually negotiating both points would very obviously be the right, nice, sensible, intelligent and decent thing to do. Or is that asking too much of a Bullingdon Club Tory?

(1) interesting reading English people commenting on this and how its all about Scotland wanting its cake and eating it. Even if it was, and? Jealous? And that's besides the obvious benefits a currency union would also give to English businesses that trade with Scotland - or is the approach here one of sour grapes mixed with cutting 10% of your nose off to spite your face?

Saturday, 8 February 2014

(No) stitch in time

That last Labour lot were an utter shower. It’s cos of them

we’re in the mess we’re in, cos of them spending, make that wasting, all our

money. Wasting I tell you.

Hold that thought for a mo ….. the scenes from waterworld/Somerset

are truly gobsmacking as is the fact it appears to have been going on since

Christmas. Clearly something should have been and/or must be done about this,

except something already was – spending on flood defences in England and Wales

was cut (in absolute and real terms) years ago by the current government.

This was part of the initial approach to austerity; routine

spending e.g. benefits, are a bugger to cut as the Irritable Bowel-Duncan-Smith

experience exemplifies. Capital spending on the other hand is relatively easy, you just cancel

or postpone the building of new things like seawalls. Hence, in the early years of

austerity, capital spending, even though it’s a relatively modest share of total

government spending, accounted for a disproportionate share of the cuts. Capital

spending on flood defences illustrates this perfectly, the total being cut 27%

from 2010/11 (the last year of Labour spending plans) to 2011/12.

Now would a Labour government have done anything differently

if it’d won the last election? Doubt it. But, some of the last Labour

government’s spending looks a bit more sensible allova sudden what with

them having started ramping up spending towards the £1bn a year level that’s

been deemed necessary to cope with all the freak weather we now appear to have.

And there’s the obvious charge of short-sightedness that can

be made against the current lot. Would keeping spending at Labour levels have

prevented current events? Doubt it, but it might have ameliorated some of

them, which, given what they’ll ultimately mean in terms of additional spending

on tidying up the mess, lost economic activity and all our insurance premiums,

suggests the spending cuts may eventually cost us all far more than they

apparently saved *. Oh and it would have created jobs as well.

And BTW the above numbers are nominal i.e. don’t take

inflation into account, meaning the reduction in spending is even bigger than

it looks.

* you get the impression the nasty bedroom tax has already

gone in this direction as well what with the time and money being wasted on

chasing up newly created rent arrears and what not.

Thursday, 6 February 2014

The real arguments against Scottish independence

“They” haven’t been telling you what the real arguments are against

Scottish independence. “They” have been keeping quiet about them, not wanting you

to know. Well there’s no omerta here, not on this blog, no sir-ee*.

So here they are, these are the real deal, raw and uncut reasons

why”they” won’t vote for Scottish independence:

1) Can’t

be arsed

2) Anyway,

have you no seen that shower up in Holyrood?

3) Besides,

see that Alex Salmond, I don’t trust him

And now they’re out in the open, its easy to point out why

each one is largely pants.

Take (1), which cuts both ways. Looking over Hadrian’s wall

does anyone actually think the UK civil service, politicians or what have you

can actually be arsed with all the logistics and negotiations Scottish

independence would entail? Like take the nuclear bombs currently stored in

Scotland, do you actually think anyone in England can be arsed with storing

them given all the construction, protests, planning

permission disputes and what no doing so would generate? No me neither and that’s before you’ve started talking about the

easy stuff like who get’s what embassy (bagsie Paris for Scotland). Except,

from a Scottish perspective this isn't a reason to vote no.

(1) also

applies this side of Hadrian’s wall and can be approached via a hypothetical

conversation between a dad and his son: “So dad, why did you vote against Scottish independence (assuming you

even bothered to vote), why did you commit me to however many more years of

masochistic austerity measures used to pay for tax cuts for the rich, why did

you want me to live in a Britain where Daily Mail headlines influence education

policy, UKIP immigration policy and London & the S. East pretty much everything

else government does?” Well son, it’s because I couldn’t be arsed”.

Re: 2) you’ll get no argument here that that shower up in

Holyrood is anything, but a shower. But,

staying in the Union won’t change that

whereas leaving it will if only because cutting the Westminster

escape route

will, at the very least, force our existing politicians to compete harder for

fewer seats.

3) I

don’t get the down on Alex Salmond being too vain and sleekit personally, I mean Idi Amin is already the King of

Scotland, whereas Alex Salmond is just a politician and politicians say what they

think the electorate wants to hear. But, anyhoo, as the Labour Party in

Scotland’s gradual decline into opposition makes clear, the story of devolution

is also the story of how the Scottish electorate can’t be taken for granted; if Alex

really is such a bam, then chances are he’ll lose/get turfed out via the

wonders of democracy.

* Making these arguments a serious part of the mainstream

debate would risk highlighting the apathetic and ignorant nature of much of the

electorate, the utter mediocrity of Scottish political life and an associated fixation

with the personal that’s trivial even by Nick Robinson standards.

Wednesday, 5 February 2014

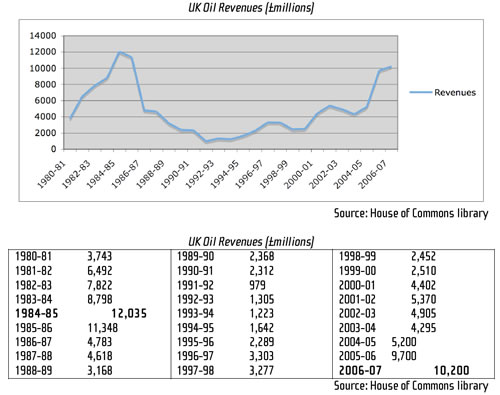

A UK North Sea Oil sovereign wealth fund and other fairy tales

As long as Scotland remains a part of the UK, there will

never be a Scottish let alone a British North Sea Oil funded sovereign wealth

fund. The reasons why are almost entirely political.

To set up a fund now would undermine the notion Scotland

benefits financially from being part of the UK especially the more vicious form of this argument that claims England subsidises public

spending in Scotland. Setting up a fund now would also prompt questions about

why wasn’t it done sooner like in 1990 when Norway set up what’s now the

largest fund in the world. More than this it would call into question the credibility

and policies of previous governments, Labour and Tory (but particularly the

1980s Tories i.e. Thatcher). Finally, a fund would have too much symbolic meaning; it would be a powerful Scottish nationalist

(and Nationalist) totem and a recurring reminder that for quite some time now no Scotland very clearly hasn't been "better together".

So we won’t get one (and neither will the UK). Instead, without Scottish independence, today’s revenues will continue getting spent today, there’ll be no north sea oil funded investment in Britain and no meaningful legacy for future generations.

Instead, the best we’ll get is yet another “expert” being trotted out to claim (yet again) that future production and revenues are in secular decline (other than when they aren't - see graph/numbers above, recent headlines about record investment in the North Sea by super majors etc.,), so it just isn't worth the candle (well if its so unimportant, there'd be no harm setting one up then).

So we won’t get one (and neither will the UK). Instead, without Scottish independence, today’s revenues will continue getting spent today, there’ll be no north sea oil funded investment in Britain and no meaningful legacy for future generations.

Instead, the best we’ll get is yet another “expert” being trotted out to claim (yet again) that future production and revenues are in secular decline (other than when they aren't - see graph/numbers above, recent headlines about record investment in the North Sea by super majors etc.,), so it just isn't worth the candle (well if its so unimportant, there'd be no harm setting one up then).

Wednesday, 29 January 2014

Is the case for Scottish independence in tatters?

Mark Carney’s Scottish speech is too measured a thing for commentators not to aggressively spray it with a mixture of twaddle and tosh in a manner largely reliant on implausible strawmen.

Take the notion of control and how a post-independence Scotland that entered a currency union with the Rest of the UK (rUK) would have no control over its exchange rate. Except, all this means is an independent Scotland wouldn’t gain something it currently doesn't have i.e. there would be no change. Hence, when Robert Peston trots out the following twaddle “Now the value of the pound would tend to reflect economic conditions in the larger economic area of England, Wales and Northern Ireland, not the more recessionary conditions in Scotland. So the pound would not fall to offset the downturn in Scotland and give a boost to the export prospects of Scottish companies”, he is ignoring the fact this is already the case.

As for tosh, Robert Peston then goes on, in a Treasury paper type styley, to say that “the economies of Scotland and that of RUK would

diverge”, this being, it would appear, a terribly bad thing because a Rest of

the UK set monetary policy might not suit Scotland.

Except, again this is already the case and besides here’s what

Mark Carney actually said about divergence: “Surprisingly, a review of major

currency areas suggests that similarity is neither necessary nor sufficient for

success. For example, the industrial structures of the core and periphery of

the euro area are more similar than those of the constituents of Canada or the

US (table 1). Yet few would argue that

the euro area is the most effective currency union of the three. Conversely,

the Canadian monetary union works well despite having substantially larger

industrial variation than even the US …..being similar doesn’t necessarily help

and being different doesn’t necessarily hinder”.

Mark Carney then says there would also be a

need for a banking union, which would entail:

1) Common

supervisory standards,

2) Access

to central bank liquidity and lender of last resort facilities,

3) Common

resolution mechanisms, and

4) A

credible deposit guarantee scheme

Now, this is the ideal type scenario, the EU not having all

of the above, but anyhoo, lets take each in turn:

1) Fine,

give us a copy of the rule book we’ve already part paid for and that financial

institutions already adhere to, sometimes (and because a Scottish financial

system would be much simpler e.g. no hedge funds or investment banks, it would

also be cheaper to supervise)

2) Hmm,

this is a bit trickier

3) Nae

bother, we’ll get a copy of the rule book when its finally agreed (there isn’t really

one at the moment) and/or introduce the necessary laws into the Scottish

parliament using the UK precedent.

4) You

mean like the one all the foreign banks already operating in London already

have? Oh go on then.

Suddenly independence isn’t an especially daunting prospect anymore and that’s before we get to the meat of the issue and the prize;

fiscal policy or to quote Mark Carney “there is an obvious tension between

using robust fiscal rules to solve this problem, and allowing national fiscal

policy to act as a shock absorber. This reinforces the need for fiscal risk

sharing between nations. “

Or to put it another way, an independent Scotland wouldn’t be

able to tax and spend exactly how it chose, be that recklessly or not. Except

we knew that already and anyway, even if Scotland had an independent currency,

the bond markets and rating agencies would make clear what appropriate

government debt levels and spending levels would be.

However, even if total government spending could only vary

incrementally from the rUK, there is obvious scope for what the total gets

spent on to vary significantly, which actually matters a lot.

Two quick examples: First, transport and infrastructure – Right

now, Crossrail is Europe’s biggest construction project. At a cost of c.£16bn it will make it easier to commute across London. When Crossrail is finished

it looks like the biggest construction project will be HS2, which will make it

easier to commute into London. Before Crossrail, the Chunnel was probably the

biggest construction project, which made it easier to travel from Paris to - wait for it, wait for it - London.

Then there’s the possibility of another Heathrow runway, which would make it

easier to travel into London from well anywhere really i..e. an independent

Scotland would be able to spend the same amount of money it currently

contributes to rUK infrastructure spending, but on things other than the long-term UK commitment to massively subsidising

London commuters, like have you seen the state of the roads round Aberdeen,

howzabout finally reinstating the Waverly line or having a dual carriageway all the way through the borders?

Second, military spending and foreign policy; in one of his

pro-Union speeches Alastair Darling highlighted the phallic size of the British

military budget as if spending all that money on being able to kill people was

a good thing. Except, whereas Britain had the 4th largest military budget in

the world in 2013 and spent a bigger share of its GDP on it than Japan, France,

Italy and Germany, the British economy was only the 7th largest. So here’s a mad proposal, an independent Scotland could pay

itself a peace dividend by cutting military spending back to a level either in

line with its economy or less than. Then, it took the money saved and spent it on

mad shit like social housing, education, care for the elderly, economic

development and so on without breaching any overall fiscal rules (and not

invading anymore countries at the behest of the US).

So does Mark Carney’s speech leave the case for independence

in tatters? No it fucking well does not.

Friday, 24 January 2014

Lies, damned lies and ..... what's the point?

Anyone pointing out that the data released by the Treasury showing

pay is actually increasing in real terms is a crock of &*£" is missing the point.

The reality is that average pay growth has and continues to lag inflation. The

latest (as at 22/1/14) available ONS data shows the average weekly wage (including

bonuses) grew at 0.9% per annum (1.2% private sector, 0.2% public sector) vs consumer

price inflation of c.2% i.e. real pay, after taking the average increase in the

cost of things into account, is continuing to fall, this time by 1%. That is the reality; pay

growth continues to lag prices ergo yer average punter is worse off today than

he was a year ago (and the year before that and the year before that one).

But, that's beside the point. Googling over to the Daily

Telegraph/Torygraph, Express and and Mail to see what they had to say about the

special Treasury release given they’re quite the ones for supporting the

current austerity regieme, as of 18.54, Friday, today, none of them were saying

anything.

Now, chew on that for a second. And a few seconds more. So the claims and data taxpayer funded government departments are

making and issuing currently appear too implausible, too readily contradicted by easily available facts for even the Tory press to actually

run with. By contrast, they're not too implausible for the BBC

i.e. the BBC now appears less sane/more right wing than the

Daily Mail when it comes to the economy.

But, that's still besides the point, which is

this; Labour have been scoring political points by going on about the cost of

living crisis. This Treasury release muddies the waters, handing every Tory

guest on Newsnight, the Today programme etc., for the next however long a time-wasting

peg on which to hang their prejudices about the consequences of the current

ConDem lot’s economic policies for the majority of people in Britain. FTSE 100 executive pay packages growing at 14%

per annum? Ahh, but the Treasury release says its actually only the top 10% that have seen their

pay lag inflation. The number of food banks is up? Ahhh, but pay is now growing

in real terms according to the latest Treasury figures. And so on.

This release is all about turning

the grinding, real terms pay cuts millions of people continue to contend with

into a distracting he-said, she-said political debate. Oh and factually its also just wrong, but due to the BBC approach to avoiding charges of bias - see climate change reporting fer instance - of presenting opposing views even when one is garbage, it could well continue to be presented as being in some way credible.

P.S. Click here for a neat demolition of the claims and here for someone pointing out its actually quite hard to get hold of the Treasury release to check the methodology and numbers. Funnily enough, the story - and associated headline - is suddenly getting a lot less prominence on the BBC website. The whole thing feels increasingly like something out of "The Thick of It"; bright young thing twists numbers into supporting the party line, party press officer gets the BBC to do a big splash, a growing number of people say WTF? and allova sudden - move along now nothing to see here - the actual story is the Prime Minister's Davos speech.

P.S. Click here for a neat demolition of the claims and here for someone pointing out its actually quite hard to get hold of the Treasury release to check the methodology and numbers. Funnily enough, the story - and associated headline - is suddenly getting a lot less prominence on the BBC website. The whole thing feels increasingly like something out of "The Thick of It"; bright young thing twists numbers into supporting the party line, party press officer gets the BBC to do a big splash, a growing number of people say WTF? and allova sudden - move along now nothing to see here - the actual story is the Prime Minister's Davos speech.

Labels:

cost of living,

inflation,

living wage,

pay,

real terms pay cuts

Subscribe to:

Posts (Atom)