Mark Carney’s Scottish speech is too measured a thing for commentators not to aggressively spray it with a mixture of twaddle and tosh in a manner largely reliant on implausible strawmen.

Take the notion of control and how a post-independence Scotland that entered a currency union with the Rest of the UK (rUK) would have no control over its exchange rate. Except, all this means is an independent Scotland wouldn’t gain something it currently doesn't have i.e. there would be no change. Hence, when Robert Peston trots out the following twaddle “Now the value of the pound would tend to reflect economic conditions in the larger economic area of England, Wales and Northern Ireland, not the more recessionary conditions in Scotland. So the pound would not fall to offset the downturn in Scotland and give a boost to the export prospects of Scottish companies”, he is ignoring the fact this is already the case.

As for tosh, Robert Peston then goes on, in a Treasury paper type styley, to say that “the economies of Scotland and that of RUK would

diverge”, this being, it would appear, a terribly bad thing because a Rest of

the UK set monetary policy might not suit Scotland.

Except, again this is already the case and besides here’s what

Mark Carney actually said about divergence: “Surprisingly, a review of major

currency areas suggests that similarity is neither necessary nor sufficient for

success. For example, the industrial structures of the core and periphery of

the euro area are more similar than those of the constituents of Canada or the

US (table 1). Yet few would argue that

the euro area is the most effective currency union of the three. Conversely,

the Canadian monetary union works well despite having substantially larger

industrial variation than even the US …..being similar doesn’t necessarily help

and being different doesn’t necessarily hinder”.

Mark Carney then says there would also be a

need for a banking union, which would entail:

1) Common

supervisory standards,

2) Access

to central bank liquidity and lender of last resort facilities,

3) Common

resolution mechanisms, and

4) A

credible deposit guarantee scheme

Now, this is the ideal type scenario, the EU not having all

of the above, but anyhoo, lets take each in turn:

1) Fine,

give us a copy of the rule book we’ve already part paid for and that financial

institutions already adhere to, sometimes (and because a Scottish financial

system would be much simpler e.g. no hedge funds or investment banks, it would

also be cheaper to supervise)

2) Hmm,

this is a bit trickier

3) Nae

bother, we’ll get a copy of the rule book when its finally agreed (there isn’t really

one at the moment) and/or introduce the necessary laws into the Scottish

parliament using the UK precedent.

4) You

mean like the one all the foreign banks already operating in London already

have? Oh go on then.

Suddenly independence isn’t an especially daunting prospect anymore and that’s before we get to the meat of the issue and the prize;

fiscal policy or to quote Mark Carney “there is an obvious tension between

using robust fiscal rules to solve this problem, and allowing national fiscal

policy to act as a shock absorber. This reinforces the need for fiscal risk

sharing between nations. “

Or to put it another way, an independent Scotland wouldn’t be

able to tax and spend exactly how it chose, be that recklessly or not. Except

we knew that already and anyway, even if Scotland had an independent currency,

the bond markets and rating agencies would make clear what appropriate

government debt levels and spending levels would be.

However, even if total government spending could only vary

incrementally from the rUK, there is obvious scope for what the total gets

spent on to vary significantly, which actually matters a lot.

Two quick examples: First, transport and infrastructure – Right

now, Crossrail is Europe’s biggest construction project. At a cost of c.£16bn it will make it easier to commute across London. When Crossrail is finished

it looks like the biggest construction project will be HS2, which will make it

easier to commute into London. Before Crossrail, the Chunnel was probably the

biggest construction project, which made it easier to travel from Paris to - wait for it, wait for it - London.

Then there’s the possibility of another Heathrow runway, which would make it

easier to travel into London from well anywhere really i..e. an independent

Scotland would be able to spend the same amount of money it currently

contributes to rUK infrastructure spending, but on things other than the long-term UK commitment to massively subsidising

London commuters, like have you seen the state of the roads round Aberdeen,

howzabout finally reinstating the Waverly line or having a dual carriageway all the way through the borders?

Second, military spending and foreign policy; in one of his

pro-Union speeches Alastair Darling highlighted the phallic size of the British

military budget as if spending all that money on being able to kill people was

a good thing. Except, whereas Britain had the 4th largest military budget in

the world in 2013 and spent a bigger share of its GDP on it than Japan, France,

Italy and Germany, the British economy was only the 7th largest. So here’s a mad proposal, an independent Scotland could pay

itself a peace dividend by cutting military spending back to a level either in

line with its economy or less than. Then, it took the money saved and spent it on

mad shit like social housing, education, care for the elderly, economic

development and so on without breaching any overall fiscal rules (and not

invading anymore countries at the behest of the US).

So does Mark Carney’s speech leave the case for independence

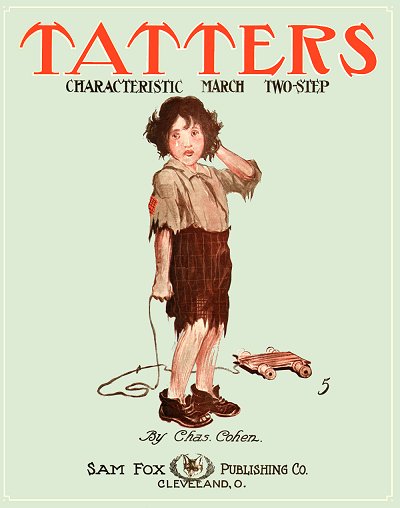

in tatters? No it fucking well does not.