Young, politicised men left Britain in their hundreds to

fight in a brutal war overseas. Driven by ideology they were willing to make the

ultimate sacrifice. Eschewing notions of nationalism, they threw themselves

into the massed ranks of an avowedly international militia formed to fight an

undemocratic, brutally oppressive regime. As is the way, foreign powers played a

part, providing the volunteers with finance and munitions, all the while using the war to test tactics

to eventually deploy on the bigger stage of their own ideologically defined grand, foreign-policy,

designs. Clearly perspective matters, but when generalising, the parallels

between Syria and the International Brigades of the Spanish civil war appear striking to me. Anyhoo.

Monday, 26 May 2014

New study proves Scottish independence would cost billions (and billions and billions)

Another day, another BBC anti-independence headline, this time its "Scottish independence: Cost of new bodies 'could be £1.5bn'"

Reading further we discover "The cost of setting up all the bodies needed in an independent Scotland could be £1.5bn, the UK Treasury has claimed. It based the figure on research into the costs of setting up

an independent state in Quebec, which have been estimated at 1% of GDP"

One wee thing, aside from all the state institutions Scotland already has, struck me reading this, Quebec i.e. French Canada, speaks French, the rest of North America? Less so. So the comparison doesn't appear especially valid (give or take the likelihood of additional subsidies for cheucters) given language imposes additional costs on a state, like translators, documentation and what no. Then there are the savings to be made from no longer paying for London based civil servants (and the associated debate over what Scotland's share of those assets should be). Hey ho.

Friday, 23 May 2014

Sharklays have broken the rules again: Part 287

Surprise, surprise, Barclays has been caught out cheating

yet another price index. This time it’s the price of gold and a deal did

wherein it agreed to pay out $3.9 million if the price was X, then the guy

running the trading desk gamed the system so the actual price turned out to be

Y. Nice. That the actual deal was done the day after Barclays was fined £290m

for libor fixing in 2012 just adds to it all along with the Barclays CEO’s

recent comments about how you need to pay top dollar to get the best staff cos

the best staff make so much money.

Picking thru the Financial Conduct Authority’s official

announcement about all this, I read how one of the reasons they fined Barclays

was because from 2004. when it joined the group of banks involved in this

specific market, it had been: “unable

to adequately monitor what trades its traders were executing in the Gold Fixing

or whether those traders may have been placing orders to affect inappropriately

the price of gold in the Gold Fixing … until 21 March 2013”

Plus, the incident they got fined for only appears to have

come to light because the customer complained prompting the question how many

others got ripped off like this over the 9 year period it was (a) possible and

(b) actively encouraged via bonuses?

The 96 grand fine levied on the guy who did it in the first

place prompts additional questions like; is that it? When do the fraud charges

start? Why so small a fine given how much he received in pay and bonuses as the

director of a trading desk because you know, you need to pay top dollar to get

super star traders to work for you?

Then there’s the bigger picture and how when the libor

scandal first broke some fools claimed there was nothing to see here and that

we should all just move along because it was no more than one or two rotten apples. This

argument was utter pants then and even more pants now that yet another investment

banking activity has been shown up to have been open to systematic abuse for

years and to have actually been abused in practice.

Next time someone speaks out in favour of big banker

bonuses, the question they need to answer is how do they know these are

rewarding expertise rather than criminality because what the latest Sharklays example makes clear is that the banks themselves can’t actually tell the

difference (hence the FCA fine!). In the meantime, where we to err on the side of caution, it

increasingly looks like a reasonable chunk of big investment banker bonuses

could be more accurately described as the proceeds of out and out crime!

Thursday, 8 May 2014

Social mobility chat

Public chat about social inequality and social mobility is

typically bollocks, 2 reasons being ignorance

about what happened in the past and a failure to acknowledge how classes actively strive to reproduce themselves as best they can.

Starting with the past, if I remember my (very simplistic)

reading of John Goldthorpe correctly, essentially post war Britain saw the number of middle

class jobs grow faster than the middle class could breed to fill them; lo and behold - more working class people got middle class jobs. Now? Less

so, especially now that so many middle class women have actual careers.

Then there’s class reproduction, which for someone like me is about giving my child every practical advantage I can. This includes stuff like having the cash to move into the catchment area of a good school,

paying for additional tutoring, a private education etc. Then there’s

the practical stuff like what to wear for a job interview, how to write a CV or what careers to consider (and which uncle or aunt to talk to about them beforehand) etc., However, its the "soft" cultural stuff I remember most from my childhood, like exposure to ways of

discussing and arguing and, the most powerful for me, the

basic assumptions and expectations about what I would go on to do with my life and where.

Oh and one final thing, the chat politicians come out with

about training and skills and what no ignore the reality which is that there

will always be low skill, low wage work. Plus, the training and skills chat buys into the high

skills get high pay rhetoric used to justify inequality.

What I take from all of the above is simple. The first is you can’t

change the structure of occupations overnight. The second is that greater social mobility would entail taking on middle and

upper class parents who are all in favour of mobility when it involves their kids getting on, but less so when its a threat from "below". So debate all you want about education and what no, but in the meantime just introduce a living wage fer chrissakes.

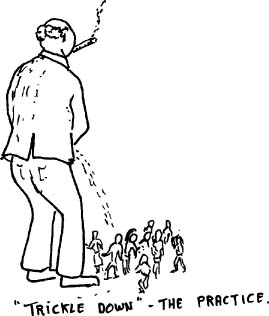

Slaughtering the capitalists

Reading Allister Heath on Thomas Piketty was

interesting, especially the last bit where he says “supporters of capitalism need to get their

act together. They are being slaughtered on the intellectual battlefield by

opponents who are finding sexy new justifications for their old arguments. We

need more and better defences of the free enterprise system, and we need them

now.”

Poor Mr Heath. The problem he and every other supporter

of capitalism in the liberalising, free-markets for everything mould face is

their refusal to accept there is a ruling class and that what a ruling class does, wherever possible,

is structure a society to suit itself so as to get and keep a disproportionate share of wealth and power (see fer instance the Chinese Communist party, Putin and the Oligarchs and those lovely people

who sit on the boards of investment banks in Britain).

So while Heath and Piketty are essentially both challenging the same ruling class privileges (from differing positions), Heath's worldview leads him to try and defend the rich - rather than the ruling class - by justifying inequality as being for the good of us all (wealth creation, rewards for risk takers, ya de ya de ya da), whereas Piketty’s supporters are free to challenge the monolith, by tearing down some of the shibboleths.

Theory aside, facts are the other reason supporters of

capitalism are getting slaughtered right now. We now know superstar investment banker

bonuses frequently resulted from breaking regulations governing money

laundering and every kind of price index imaginable, that our banks

privtised gains and socialised/nationalised losses, that outsourcing can lead to

fraud, that the Post Office privitisation fiasco benefited a mate of George Osborne, that much of what goes on in finance is simply tax efficient financial engineering not wealth creation, that celebrities and multinationals led by

multimillion pound CEOs dodge taxes with impunity and so on and so forth at the

same time as FTSE executive pay continues to grow faster than the economy i.e.

the rich and powerful keep taking a bigger slice of the cake in exchange for

less and less.

To Heath calling this out is “envy”. Except, its

not, its simply pointing out how the British ruling class actually behaves in

all its smug, arrogant, fiver-grasping, self-serving, greedy, cheating,

fraudulent and - most importantly of all - profoundly incompetent glory. And the reason I reckon Picketty’s book is finding such a

wide audience is because in these austere times, with mainstream political debate barely acknowledging the way things are in any meaningful ways, ordinary people have fewer

things distracting them from the pro-ruling class shite people like Heath are

paid to rain down upon their heads.

P.S. Here's a few practical proposals even Mr Heath might agree with

1) The investment banks that advised on the Post Office sell off don't get any more government or government related work until they compensate the taxpayer.

2) The investment bankers getting done for the libor fiddling etc., - any found guilty also get done under the proceeds of crime laws i.e. their bonuses get taken off them along with their salaries and other assets.

3) private equity and multinationals start getting taxed fairly

4) executive pay is disengaged from company size, benchmarking takes European companies into account (in this global war for talent), total compensation is made a multiple of average company pay and golden parachutes are unpacked/got rid of.

5) Rather than tax amnesties i.e. discounts, for coughing up what's owed, the threat is prison and being barred from any roles with any meaningful responsibilities

Bullshittery

Barclays are truly the obfuscating spin-meisters. My

personal fav remains the time they announced 2,100 redundancies in one area one

day and 2,100 elsewhere shortly afterwards, the point being to generate

headlines about 2,100 rather than 4,200 job cuts. And so it was today when you

google the latest Barclays job announcement you get the BBC quoting 14,000

(later revised to 19,000), the Telegraph at 7,000 and the Guardian at 19,000.

Job done. Then you had the BBC interview with the Barclays CEO himself where he

said they’d no “set targets for branch closures”, which is most likely true to

an extent i.e. they’re probably still debating how many to close, but you can bet

– given the actual strategy document says “We believe that cost is the strategic

battleground for our industry” - that plenty will be closing.

Aside from this being another example of supreme corporate

bullshittery/media ineptitude, its interesting how little it appears to matter.

The Barclays strategy of closing/selling/running down its European retail bank

operations is not a good thing for the UK’s balance of trade. The actual job

losses are pretty huge and follow on from the tens of thousands of job losses already

seen across banking as a whole, the vast majority of which have not involved casino

bankers on 7 figure bonuses. But hey ho, it’s a measure of how loathed banking

is that this other kind of stuff just doesn’t seem to matter – a CEO gets multi

million pound bonuses and pay offs for signing off on and leading a disasterous

strategy? Well lets make 10,000 branch tellers redundant then, that’ll teach ‘em.

Wednesday, 7 May 2014

Them an'all

I’m always suspicious of middle aged men with stoopid facial

hair, but Steve Pottinger’s letter to Café Nero about it not paying taxes is

fun. Predictably, because of the Starbucks debacle, this got picked up by

various media outlets none of which appear to have picked up on the bigger

picture; Café Nero avoids paying taxes because it has a lot of debt and the

interest it pays on this is tax deductible.

This is integral to the private equity business model – what

Café Nero does (or doesn’t when it comes to paying taxes), pretty much every

other private equity owned company does as well, meaning shops like Poundland, McColls

and Pets At Home. You could also add Boots (from memory) to the list and utterly ghastly bastards like Wonga.

The tax treatment of private equity is a big deal I reckon,

but then so is the tax treatment of transfer payment malingering multinationals,

but hey ho, we’re all in this together, green shoots of recovery, galloping

social and economic inequality and all that.

Subscribe to:

Posts (Atom)