As long as Scotland remains a part of the UK, there will

never be a Scottish let alone a British North Sea Oil funded sovereign wealth

fund. The reasons why are almost entirely political.

To set up a fund now would undermine the notion Scotland

benefits financially from being part of the UK especially the more vicious form of this argument that claims England subsidises public

spending in Scotland. Setting up a fund now would also prompt questions about

why wasn’t it done sooner like in 1990 when Norway set up what’s now the

largest fund in the world. More than this it would call into question the credibility

and policies of previous governments, Labour and Tory (but particularly the

1980s Tories i.e. Thatcher). Finally, a fund would have too much symbolic meaning; it would be a powerful Scottish nationalist

(and Nationalist) totem and a recurring reminder that for quite some time now no Scotland very clearly hasn't been "better together".

So we won’t get one (and neither will the UK). Instead, without Scottish independence, today’s revenues will continue getting spent today, there’ll be no north sea oil funded investment in Britain and no meaningful legacy for future generations.

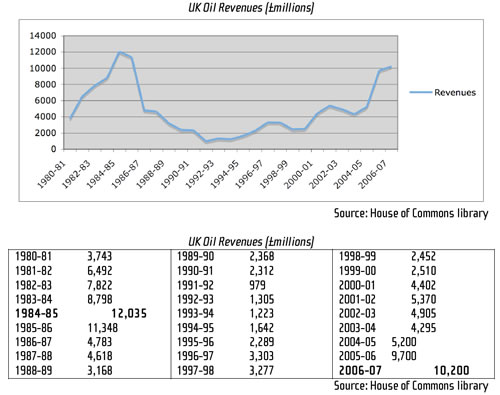

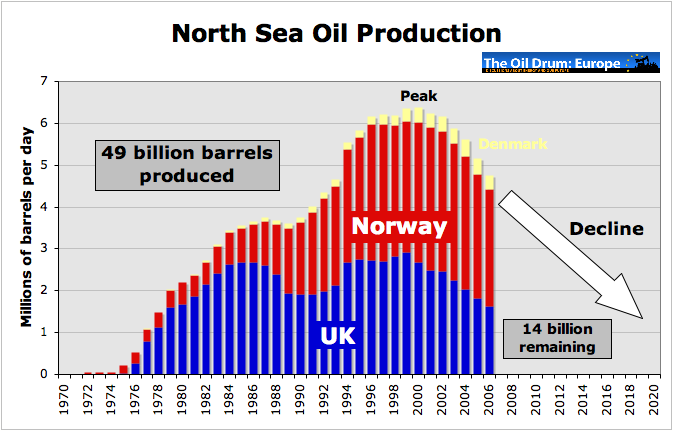

Instead, the best we’ll get is yet another “expert” being trotted out to claim (yet again) that future production and revenues are in secular decline (other than when they aren't - see graph/numbers above, recent headlines about record investment in the North Sea by super majors etc.,), so it just isn't worth the candle (well if its so unimportant, there'd be no harm setting one up then).

So we won’t get one (and neither will the UK). Instead, without Scottish independence, today’s revenues will continue getting spent today, there’ll be no north sea oil funded investment in Britain and no meaningful legacy for future generations.

Instead, the best we’ll get is yet another “expert” being trotted out to claim (yet again) that future production and revenues are in secular decline (other than when they aren't - see graph/numbers above, recent headlines about record investment in the North Sea by super majors etc.,), so it just isn't worth the candle (well if its so unimportant, there'd be no harm setting one up then).