A thing that bugs me about The Economist is its

bias. Like with Hugo Chavez, in what was effectively an obituary they still

found time to go on about his recklessness and his “corrupt, oil-fuelled autocracy”, but failed to mention how in amongst the grandstanding, Venezuala

has a soveriegn wealth fund worth $800m.

By contrast Scotland and the rest of the UK doesn't have one at all, which makes North Sea oil, so far, an incredible, missed opportunity. Sure, go to Aberdeen and you’ll see more new build executive villas, 4x4s and giant plasma screen tellies than you can shake a stick at. But, these belong to people who – like the UK government – are spending today what won’t, evenetually be there tomorrow.

By contrast Scotland and the rest of the UK doesn't have one at all, which makes North Sea oil, so far, an incredible, missed opportunity. Sure, go to Aberdeen and you’ll see more new build executive villas, 4x4s and giant plasma screen tellies than you can shake a stick at. But, these belong to people who – like the UK government – are spending today what won’t, evenetually be there tomorrow.

This uniquely British approach to oil dates back to the 1976 UK financial crisis that

saw Britain apply to the IMF for a bail out. In these circumstances the

associated rush to bring oil on shore made sense as the new revenues then helped

ease immediate and pressing financial problems (the "lax" approach to

health and safety this also involved is somewhat less justifiable, but does strenghten

the moral case for regarding North Sea oil as a distinctively Scottish asset). Over

time the UK government’s fixation with spending every penny oil generated as

soon as it could became less justifiable, something that made North Sea oil forward

production curves increasingly handy.

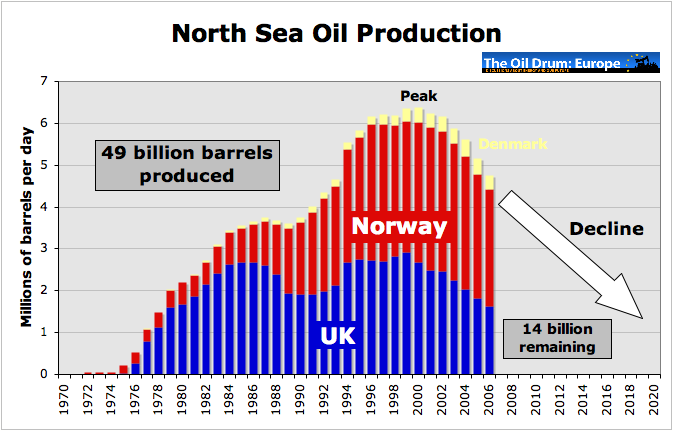

I’ve seen loads of these production forecasts over the years,

so many I just pulled the one presented above randomly off the internet without

bothering to check when it was produced. This is because each one tells the

same story; North Sea oil production has peaked, it’s now in decline and within

a couple of decades it’ll all be gone. Given this (1) why bother setting up a

soveriegn wealth fund and (2) Scotland had better stay in the union because

when the oil runs out we’ll be fecked.

Except, every year when the production curves get refreshed they push the end date out another few years. The reasons why are straightforward. Well

when I say reasons, I mean reason. So sure sure, technological advances are a

factor, but really it’s about price. As North Sea oil is relatively

expensive to produce, North sea oil production has a relatively high hurdle

rate i.e. the price below which its not worth bothering about. Hence, every production

curve is actually a forecast of how much oil it will be economic to produce, not

how much is left. As prices rise more oil becomes economic to produce

and the production curve shifts that bit further to the right. Globally, the most obvious example

of this are the Canadian tar sands, which have gone from being well sand really

to one of the world’s largest oil reserves.

Now, picking through the historic data what stands out is

how in the past supply side shocks have driven oil prices to record highs. Now

though its more to do with demand due to global economic development, most

obviously Chinese economic growth. And as this isn’t going away any time soon, while oil

prices will certainly move about in the future, they remain unlikely to fall back to

the levels seen in the 1990s anytime soon.

This in turn means North Sea oil will be with us for a good

while yet, which has obvious implications re: the Union. As no UK government has ever shown itself to be the slightest bit willing to view North Sea oil as anything other than an immediate

cash cow to be milked as aggresively as possible, staying in the Union means

when North Sea oil does eventually run out, the benefits of this once in a

(nation’s) lifetime opportunity will already have been frittered away on tax cuts

and London based legacy projects. Plus, the Scottish post-industrial experience

suggests Aberdeenshire’s post-oil experience will not be pretty.

Given this independence is the only option if we want to establish a permanent, positive North Sea oil legacy. Leaving the union and establishing a Scottish soveriegn wealth fund will also address the volatility issue raised by the UK treasury in its scaremongering tosh about Scottish independence – in good years more money gets paid in, in bad years less. There. Sorted. Easy.

To put this another way, I’d rather North Sea oil revenues eventually funded the university I hope my grandchildren attend than had been pissed away putting up the millenium dome.

No comments:

Post a Comment