The FSA judgement on Peter Cummings is interesting for all sorts of reasons, notably its fundamental flaws. Cummings' repugnantly unrepentant whine, as quoted in a BBC article is also interesting; "(f)or the past three and a half years I have been singled out and

subjected to an extraordinary Orwellian process by an organisation that

acts as lawmaker, judge, jury, appeal court and executioner."

That Cummings appears aware of how organisational power can enforce a worldview wherein 2+2 = 5 is a revelation, but am guessing he actually meant Kafkaesque. Am also guessing he doesn't know any better. Ignorant dick.

Wednesday, 12 September 2012

Tuesday, 11 September 2012

Where's it gone?

Is this it here? Have you looked under there? On top of

that? Nope? Then I don’t know either. Do you know where the threats British

banks made to relocate overseas in response to potential regulatory changes

they didn’t like have gone?

They definitely used to be here, like they were very loud and clear and deliberately made part of the bank regulatory reform debate. And

there were loads of them as well; HSBC (the drug barons’ bank of choice) had

one, so did Barclays (Libor rigging) and Standard Chartered (Iranian sanctions?

Pfff).

Yeah it is weird. Like when Barclays was subsequently forced to change its utterly irreplaceable CEO, you'd have thought that would have prompted a mass exodus overseas.

Was it the implicit government subsidy/insurance policy

other countries wouldn’t be able or willing to provide that proved too big a

barrier? Or was it the reality of not having UK regulators to back them up when

the Americans got a hold of their nads that prompted second thoughts? Mebbe it

was only ever disingenuous sabre rattling that was taken too seriously by

politicians/media too used to the old approach of banks get what they want or

else(!).

So yes there is the positive here of this loss signalling the terms (or at least the rhetoric) of the debate have changed, but its still a fundamental shift in policy that perhaps the next big bank bod to be questioned could explain. Oh hang on, the

other thing we’ve lost (assuming we had it in the first place), is a practical

memory when it comes to things like this.

Saturday, 8 September 2012

None so blind as those who will not see

So why exactly does the BBC go SOOO easy on, to the extent

of misrepresenting, the American right?

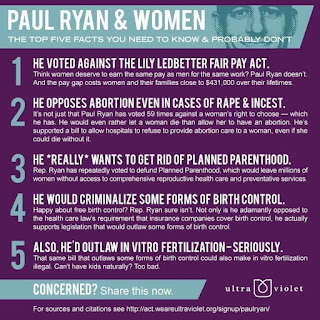

Partly, I think its because nasty bastards like Paul Ryan

are only ever found on the extreme fringes of British politics so when the BBC

is confronted by what he actually believes in, says, votes and campaigns for,

they instinctively assume he’s not being serious and selectively

tone down how he’s portrayed into something it finds more palatable.

The other thing is the BBC is lazy and relies on predictable

tropes for communicating the news. When it comes to America this means viewing

everything in terms of the “special relationship”.

Practically, this involves producing stories that:

-

exaggerate the importance of the UK to the US as a strategic partner

-

exaggerate the influence the UK

has on the US

-

exaggerate the attention paid by US politicians and the

US public to the UK, its politicians and the Royal family

-

downplay the extent to which the UK is just another mid-size

economy/political player

-

downplay the extent to which UK support is taken for granted

Then on the back of this periodically debating whether there

still is a “special relationship”, its costs/benefits, producing documentaries

that examine it (all predicated on the assumption that there is one) and so on.

The problem Paul Ryan poses here is straightforward;

no one wants to be a relationship with a nasty mentalist, special or otherwise.

To actually produce accurate reports would expose this. The BBC

response? To provide only biased and highly selective accounts that leave deluded notions

of the "special relationship” intact by leaving out the batshit crazy nasty

aspects of actual Republican politics.

Labels:

bbc,

biased reporting,

media bias,

paul ryan,

the special relationship

Monday, 3 September 2012

A dignified part

A

cool thing about America

is how looking at stuff there gives an insight into how shit is/will be here

in an if only I could see myself how others do style. Not everything of course,

but some good ‘uns, my personal favourite being the Military Industrial Complex

(MIC).

The MIC is so popular with the US left it figures in “pop” songs. Calling it out highlights the actual relationship between private military contractors and the state and how the former lobbies for increased defence spending, using the profits this generates to grease the revolving door between the two that sees officials responsible for spending taxpayer monies subsequently taking up well paid jobs with contract winners on a regular basis.

The MIC is so popular with the US left it figures in “pop” songs. Calling it out highlights the actual relationship between private military contractors and the state and how the former lobbies for increased defence spending, using the profits this generates to grease the revolving door between the two that sees officials responsible for spending taxpayer monies subsequently taking up well paid jobs with contract winners on a regular basis.

So the

MIC draws attention to the vested interests and general bentness of government

spending. Obviously nothing like that happens here what with our civil service

having a deep and profound public service ethos give or take the PFI/PPP

private sector bods who advise government on err PFI/PPP, the Ministry of

Defence bods who get jobs with BAE etc., etc., ....

Actually, this reality prompts questions about why we tend to delude ourselves about such obvious bentness given how much raw vested/self-interest figures in our lives as well. Am guessing it's because we remain suckers for the “dignified part” of the constitution Walter Bagehot went on about and kid ourselves its all fair play and a good innings ya de ya di bollocks. Like click here for a wonderfully naive example of some middle class English bod placing as much faith in the power of "independent" truth as an attorney played by Julia Roberts would in a Hollywood shitfest.

Actually, this reality prompts questions about why we tend to delude ourselves about such obvious bentness given how much raw vested/self-interest figures in our lives as well. Am guessing it's because we remain suckers for the “dignified part” of the constitution Walter Bagehot went on about and kid ourselves its all fair play and a good innings ya de ya di bollocks. Like click here for a wonderfully naive example of some middle class English bod placing as much faith in the power of "independent" truth as an attorney played by Julia Roberts would in a Hollywood shitfest.

That

aside the interesting thing right now is how little liberal American critiques

of the American polity and the American right appear to be resonating here

despite the reality. Starting with the polity, it’s the whole Washington is in its Wall Street paymasters’

pockets due to the reliance of politicians on political donations thang. Here?

Ach, its totally and completely different, like “Under Cameron, forexample, the proportion of Conservative Party funding derived from the Cityrose by 25% in five years to make up 50.8% of the Party’s total – 27% of thiscame from hedge funds and private equity”. Oh. Oh dear.

But, hey that’s just cash

for "dignified" knighthoods isn’t it, like it’s not as if financiers are backing up the

influence and access their money gives them with policy ideas by promoting and supporting think

tanks and policy proposals? Like its no as if 6 board members of

the Tory Centre for Policy Studies think tank are bigwig fund managers, investment bankers or private

equity bods. Oh, they are? And the only significant industry grouping on its

board is finance with no other industry or sector having any meaningful

representation whatsoever? Really? Oh.

Here, lets look at the BBC coverage ofPaul Ryan’s conference speech where he told a run of absolute, blatant whoppers to the extant that some US bods are now talking about “post-truth” politics wherein, contra Matthew Parris, politicians tell humungous porky pies the media doesn’t bother to check.

Thankfully the Beeb in its lovely and objective way called him out every time by referring to Ryan’s speech/whopper list as having contained some “alleged inaccuracies” (?), “errors”(?) and that for some he was “slack with his facts” (WTF?) and was open to the charge of “misleading his audience”. Oh. No, not really, rather he told a run of utter whoppers, like UTTER whoppers with them and the marathon time thang indicating he’s got a pathological aversion to anything not in keeping with his worldview/public image.

Oh dear. This example actually suggests that when a US politician on the right lies thru his pants in public, his recent personal association with efforts to get utterly revolting notions of rape built into US law gets forgotten by our licence payer funded journalists because they're too busy twisting themselves in semantic knots trying to tone down his tendency to tell utter whoppers. Oh dear 2x.

Again the short-term question this prompts is why. Longer term, given Labour has already half-inched loads of Obama rhetoric, it’s whether in an era when the financiers that fucked the UK economy still have an obviously disproportionate influence over the UK polity in ways that reek of hotdogs, we’re also heading towards a post-truth politics. That or whether we’re already there.

Labels:

bbc bias,

bbc news,

british politics,

paul ryan,

Tory funding

Tuesday, 24 July 2012

Northern Shock

* "sell-off nets extra £538m for taxpayers" - I saw this headline in an article on the sale of Northern Rock and thought cool.

It stems from Virgin buying a further £465m of Northern Rock's mortgage assets and agreeing to pay an extra £73m in cash for the bit it’d already bought for £747m. Which is lovely and straightforward; 465+73=538. That plus 747 gives £1,285m doesn’t it? Except “UKFI has estimated that the government could ultimately receive more than £1bn” vs the original £1.4bn invested in it by government on the taxpayer’s behalf.

This left me confused, like where’s the extra £285m gone then? Best to head over to the National Audit Office (NAO) report on all this and see what its saying.

It stems from Virgin buying a further £465m of Northern Rock's mortgage assets and agreeing to pay an extra £73m in cash for the bit it’d already bought for £747m. Which is lovely and straightforward; 465+73=538. That plus 747 gives £1,285m doesn’t it? Except “UKFI has estimated that the government could ultimately receive more than £1bn” vs the original £1.4bn invested in it by government on the taxpayer’s behalf.

This left me confused, like where’s the extra £285m gone then? Best to head over to the National Audit Office (NAO) report on all this and see what its saying.

Ahhhhh, I see. The main NAO focus was on whether the Virgin deal represented value for money for the taxpayer, what with Northern Rock having been split into a good bank and a bad bank (the good bank being the bit Virgin bought). And aye weren’t there suspicions (and chat) at the time that it got a bargain what with it getting “Customer accounts of £21 billion matched by £10 billion higher-quality mortgages and £11 billion cash” for £747m?

Well the NAO think the Virgin deal was good value because Virgin paid 80-90% of the good bank’s book value at a time when the market prices for major UK banks was around 50 per cent of book value. Crikey, that does sound good.

Its just, its just …… the Northern Rock bit that got sold was in no shape or form comparable to a major UK bank; its an apple and they’re all oranges give or take the odd lemon. Like (1) It has a “clean” mortgage book made up only of the good stuff i.e. it involves a lower risk of future losses than the mortgage portfolios of any other major bank (2) It’s a purely retail i.e. mortgage bank, so is and is likely to remain far safer than any of the universal portfolios major UK banks actually have i.e. there’s none of the corporate, by which I mean the leveraged finance and commercial property, dreck that have been and remain the primary drivers of UK bank losses. And (3) its no exposure to the Eurozone with all the risks (and associated losses) that entails. So too bloomin’ right it should have been sold at a significant premium to other major UK banks.

The other thing is the reference to the sale transferring billions and billions of cash. I’m not sure what that actually means like did Virgin pay £747m for £11bn in cash? If so I’d like some of that sweet, sweet action. Alternatively, it means that when it was sold Northern Rock had an incredibly liquid i.e. strong, balance sheet. Hence, this alternative report on the sale states Virgin got a “£14bn mortgage book” and “a £16bn retail deposit book”, which is a loan to deposit ratio of 88%. Crikey! That's low and again emphasises how the sale involved assets in no way comparable to other major UK banks.

And remember Northern Rock failed because it was overly, like MAD overly reliant on wholesale funding and had a loan to deposit ratio of something like I don’t know 20p in customer deposits for every £1 lent as opposed to the good bank’s eventual 16p for every 14p lent. So Virgin need only make modest tweaks to its new bank’s funding profile, shifting assets from no/low return highly liquid things into some-return less liquid things and it’ll increase its profitability in an instant. Hmmmm............

Then there’s the bad bank we’re still left with and its £54bn of mortgages that are being gradually wound down. This bad bank is so bad it made total profits before tax of £1bn in 2010 and 2011! And the increase in the return on the sale of Northern Rock stems primarily from the additional £465m in (profitable) mortgages sold to Virgin i.e. its not really that what Virgin paid for the good bank has increased, rather its paid out more for additiona assets that appear to be rather profitable. It’d also be interesting to know if Virgin buying these assets affects its loan to deposit ratio. It’d also be interesting to know if the plan here is to sell off more of the bad bank to Virgin in due course.

All this makes me wonder given it sets a precedent for the handling of the taxpayer’s remaining and far larger bank investments. Like based on the Northern Rock experience:

1)

Government appears

willing to sell early at a chunky loss

2) NAO assessments

involve some seriously spurious bollocks

3)

Sod it, why wasn’t

it held on to for a good few years more until market conditions for a sale had

improved with more money repaid in the meantime and the EU told, in a French accent, to stick their December 2013 deadline somewhere Greek

4)

The reporting of

this is pants, being either inconsistent, incoherent or both; like where’s this

extra £285m gone then and can a distinction between the sale price and any cash generated via subsequent (and additional) asset sales no be made?

* apologies for the obligatory Northern Rock bank run piccie

* apologies for the obligatory Northern Rock bank run piccie

Monday, 16 July 2012

Sharclays

I mind a colleague far better versed in the ways of “The City” than me referring to Barclays as Sharclays. I also mind someone I worked with heading off to work there, in BarCap to be precise. What made this bod memorable was that he was well known for being an arse and generally useless; last I heard he was doing rather well thank you very much. So really, the libor scandal is all about one bank’s culture, that and a few rotten apples who have thankfully been resigned allowing the lessons to be learned following a root and branch review.

Except, it very bloody obviously isn’t. As the former Barclays Chief Operating Officer has just made perfectly clear – the Bank of England had a word with the former Barclays CEO who then had a word with the former Barclays COO, who then told the relevant people to game libor. End of *.

Now some context here would help; in 2007 and 2008 the slightest whisper about a bank prompted all sorts of speculation, panic and potential crises of confidence. In this atmosphere, a quiet, unrecorded word with terribly important executives made pragmatic, if not legal, sense; better a “cheeky” wee fix now than another part-nationalisation later.

Unfortunately, the US’s more robust approach to white collar crime appears to have got in the way. Hence, we have the spectacle of the Treasury Select committee huffing and puffing, the FSA and the Bank of England saying they knew something was not quite right over at Barclays and the BBC's strenuous efforts to very obviously skew, distort and disguise what happened.

Hence for Robert Peston, our very own voice of objective financial market reportage and reason, the former Barclay’s COO saying he simply did what he understood the Bank of England said they wanted is actually proof of “Barclays' 'culture of pushing the limits'. This in turn followed an earlier Peston post asking if the Bank of England boy involved was a “Victim of his own innocence?” an interesting question to ask of a fucking deputy governor of the Bank because it’s so very obviously, but distractingly stupid.

The real point is straightforward; the party line here is to manage, massage and manipulate the news in ways that avoid exposing the status quo and limit any investigation of what went on; the "narrative" here is that some blinking foreigner and a few dodgy cronies at a rogue institution, off their own bat mind, gamed an honourable British system. Saying this often and loudly enough should hopefully drown out all the British financial regulators phoning their American counterparts to say “would you please be a good chap and shut the fuck up.”

Why this all took place is understandable. Given it’s documented in emails, there’s little debate as to its substance either. What subsequent events say about the way things are reported in Britain, how they’re managed, like how the SFO only eventually decided to investigate a very obvious fraud, i.e. the way “the establishment” works is actually the real story.

* From memory Barclays distinguished between two phases of gaming the system. One, the earlier phase, was out and out bent . The above only refers to the second phase.

Except, it very bloody obviously isn’t. As the former Barclays Chief Operating Officer has just made perfectly clear – the Bank of England had a word with the former Barclays CEO who then had a word with the former Barclays COO, who then told the relevant people to game libor. End of *.

Now some context here would help; in 2007 and 2008 the slightest whisper about a bank prompted all sorts of speculation, panic and potential crises of confidence. In this atmosphere, a quiet, unrecorded word with terribly important executives made pragmatic, if not legal, sense; better a “cheeky” wee fix now than another part-nationalisation later.

Unfortunately, the US’s more robust approach to white collar crime appears to have got in the way. Hence, we have the spectacle of the Treasury Select committee huffing and puffing, the FSA and the Bank of England saying they knew something was not quite right over at Barclays and the BBC's strenuous efforts to very obviously skew, distort and disguise what happened.

Hence for Robert Peston, our very own voice of objective financial market reportage and reason, the former Barclay’s COO saying he simply did what he understood the Bank of England said they wanted is actually proof of “Barclays' 'culture of pushing the limits'. This in turn followed an earlier Peston post asking if the Bank of England boy involved was a “Victim of his own innocence?” an interesting question to ask of a fucking deputy governor of the Bank because it’s so very obviously, but distractingly stupid.

The real point is straightforward; the party line here is to manage, massage and manipulate the news in ways that avoid exposing the status quo and limit any investigation of what went on; the "narrative" here is that some blinking foreigner and a few dodgy cronies at a rogue institution, off their own bat mind, gamed an honourable British system. Saying this often and loudly enough should hopefully drown out all the British financial regulators phoning their American counterparts to say “would you please be a good chap and shut the fuck up.”

Why this all took place is understandable. Given it’s documented in emails, there’s little debate as to its substance either. What subsequent events say about the way things are reported in Britain, how they’re managed, like how the SFO only eventually decided to investigate a very obvious fraud, i.e. the way “the establishment” works is actually the real story.

* From memory Barclays distinguished between two phases of gaming the system. One, the earlier phase, was out and out bent . The above only refers to the second phase.

Labels:

bbc bias,

Libor,

libor scandal,

paul tucker,

robert peston

Saturday, 14 July 2012

Grecian 2000 (and 12)

Despite his being that peculiar thing, a Scottish Tory, listening to Professor Niall Ferguson’s last Reith lecture, I was taken aback at how gifted and charismatic a communicator he truly is. And he’s got good hair.

The arguments he made about the current situation? Meh. Actually, delete Meh and replace with “pandering to the preservation of elite self-interest despite that being at the destructive expense of society and the economy as a whole”.

Professor Ferguson, of Harvard Business School no less, is of course a very talented Scotsman on the make who has established himself as a (very) well paid ornament of the aforementioned elite. His claim that government borrowing and sovereign debt is a betrayal of future generations is a dangerous one because it provides something that sounds like an intellectual basis that the elite might not otherwise have(or not be able to communicate so articulately) for hacking back government spending. It’s also pants with Greece providing a good starting point as to why.

Greece’s problems stem from two interlinked failures. One, successive governments racked up wodges of sovereign debt to waste on deeply inefficient public sector spending. In this respect Greece seemingly exemplifies the kind of arguments Professor Ferguson made better than any other country. However, there was and is a second Greek failure; successive governments allowed the Greek people and Greek business to dodge taxes on an industrial scale - Greeks love dodging taxes even more than they do sodomy and plate smashing.

The thing is the two failures are deeply, unavoidably and fundamentally entwined, which is why Greece actually lends little support to Professor Ferguson’s argument; a government unwilling to raise revenues i.e. taxes, has to find the money from somewhere to prop up inefficient dreck like Olympic Airlines. Hence, the Greek sovereign debt crisis is as much about tax dodging as it is wasteful government spending because debt financed both.

And as the people with the most benefit the most from tax dodging, Greece’s tragedy is as much about the wealthy camouflaging their swimming pools to avoid flying tax inspectors as it is civil servants receiving bonuses every time they wiped their arses (there is one difference between the two groups of course; Greece’s elite has been busily buying up luxury London property, off-shoring as many Euros as possible in a wonderful statement of national pride and unity. By contrast the civil servants are getting humped).

So even if you accept the notion government debt robs a nation’s children of their future at some point in the, well, future, right now Greece actually exemplifies how debt was and is being used to maximise the incomes and wealth of today’s elite.

But, Professor Ferguson is a historian and historians like facts, so lets have some. In fact lets approach this like say a Sir Lewis Namier, a dead historian who emphasised the importance of self-interest, something Professor Ferguson is profoundly enamoured with; hence, a recent study found doctors and engineers are the worst (or is that most effective?) professions in Greece for tax dodging. Now guess which two professions are heavily represented in the Greek parliament? Yup, failed vets and grease monkeys.

This is interesting. This suggests an alternative model for understanding how shit got to where it is, one where in the West economic and political elites used both public and private debt to mask the incredible growth seen in economic inequality, finance tax dodging (or tax cuts in the US/tax “efficiency” here) and, by seemingly boosting the incomes of us plebs, distract from the profound failure of “wealth” or “job” creators to create wealth for anyone other than themselves.

And sticking with Sir Lewis a mo longer, if I was a rich man, right now (or a rich man’s ornament), in between the yubby dibby dibby and the biddy biddy bum, I’d be going on at great length about how public spending needs to be cut back, how sovereign debt is a terribly bad thing, balanced budgets, couldn’t run a business/ household like that, yadda, yadda, yadda (biddy bum) i.e. doing everything I could to draw attention away from how higher taxes on capital and profits could also sort out sovereign debt (a practical policy suggestion here being howzabout next time there’s an “amnesty” for tax dodgers hiding their money off shore, the threat is pay everything or go to jail).

Subscribe to:

Posts (Atom)