So, err, there you are then as at 10.38 am the redundancy notice period (for large scale redundancies) has just been cut from 90 to 45 days.

I only found this out by chance via a noticeably bland BBC article. Reading through it I wondered why this wasn't regarded as big news given its a reasonably chunky change to the employment rights of millions of people with obvious, practical financial and employment implications for those being made redundant e.g. 45 days less pay plus 45 days less to find another job. You know, cheeky stuff like that.

At least the TUC has responded, but then you'd hope they would. Labour? Not yet although there is a "fascinating" piece on the latest inflation stats. The Guardian? Nope. Not yet.

I don't know. What I do know is it makes clear, in economic policy terms, that the ConDem's have a fixation with "supply-side reform" (as in a euphemism for stripping away employment rights) whereas (1) the UK economy is contending with a crisis of demand and (2) in terms of labour market flexibility the UK (a) already has a competitive advantage compared to much of the EU and (b) simply can't compete with Asia i.e. this is the product of nasty dogma, not reality, and is in keeping with the kind of policies Tory party donors want. Funnily enough it could also be counter-productive given it will encourage more people to save "just in case". Like if your house was on fire, this policy is the equivalent of someone trying to put it out by crapping through your letter box all the while expecting a please and a thank-you.

A 12.49pm update: So the Beeb is padding out its chat about this using articles dating back to May about how yer asset stripping, tax "efficient", debt-addicted, Tory funding, private equity boy Beecroftwas wanting things like this done. What's notable is the gap between then and now i.e. this appears to have sneaked out or been forgotten about, but hey its only employment rights, what do they matter.

Tuesday, 18 December 2012

Thursday, 13 December 2012

What does S&P stand for?

Oh no, Standard and

Poor’s (S&P) has revised its outlook on long-term UK government debt from “stable”

to “negative”, meaning Britain is more likely to lose its “AAA” rating. Oh no!

Why (oh why) I wonder? Well, it’s because they think it more likely that “within the next two years … fiscal performance weakens beyond our current expectations. We believe this could occur in particular as a result of a delayed and uneven economic recovery, or a weakening of political commitment to consolidation.” Ahh, so “fiscal performance” means onsolidating government finances i.e. cutting the deficit. Ahhhh.

But, hang on a mo, isn’t there a tension between fiscal ”consolidation” i.e. cutting government spending/raising taxes and economic growth especially right now as per the following statement; “We continue to believe the government's efforts over the next few years to engineer the planned correction in the U.K.'s fiscal accounts will likely drag on economic growth”.

Ahhhh. So there is a tension, a proufound contradiction even especially when private sector demand is so weak, between fiscal consolidation and economic growth. I wonder who came out with that mad view? Err, that’d be S&P in the same note setting out why they’ve moved the UK to a negative outlook.

Except, further on S&P then say “We could lower the ratings if we conclude that the pace and extent of fiscal consolidation has slowed beyond what we currently expect. This could stem from a reappraisal of our view of the government's willingness and ability to implement its ambitious fiscal strategy.”. So at the same time as S&P is saying fiscal consolidation is a drag on economic growth they’re also saying they’d probably downgrade the UK if consolidation slowed down?

Oh. I guess you could go off on one here about double-think. Personally, it reads to me more like S&P are setting out their “analytical” prejudices (cut spending, cut spending) and reality, then failing to acknowledge let alone reconcile the two. This would be nice if it was a purely academic exercise, except its not. Or is it?

Before some dicksplash shouts Greece, Greece like a Pink Lady gone wild, we’ve actually now got a meaningful example of what impact a UK downgrade would have; a month after France lost its “AAA”, French long-term borrowing costs “hit a record low at an auction”. So there you then, a one notch downgrade doesn’t matter diddly right now, which makes sense given there aren’t too many practical alternatives to British government debt i.e. there’s only so much “AAA” Finnish debt to go around.

Before some dicksplash shouts Greece, Greece like a Pink Lady gone wild, we’ve actually now got a meaningful example of what impact a UK downgrade would have; a month after France lost its “AAA”, French long-term borrowing costs “hit a record low at an auction”. So there you then, a one notch downgrade doesn’t matter diddly right now, which makes sense given there aren’t too many practical alternatives to British government debt i.e. there’s only so much “AAA” Finnish debt to go around.

This reality should be a marvellous and liberating thing for government policy. Now, not only can we get a real, counter-cyclical, debt funded government spending programme (social housing, social housing!) we could do so safe in the knowledge that S&P’s incoherent shite (plus whatever leaks out of Fitch’s and Moodys pants) can be safely ignored.

We should, but as things currently stand we won’t cos S&P aren't the only people to have those same prejudices plus there's the major and therefore probably politically unpalatable u-turn doing so here would involve, Shame & a Pity really. Sad & Pathetic even. Shysters & Poobahs or is it Sock-Wranglers & Pie-chart-interferers? Nah, its Shite & its avoidable Pish.

We should, but as things currently stand we won’t cos S&P aren't the only people to have those same prejudices plus there's the major and therefore probably politically unpalatable u-turn doing so here would involve, Shame & a Pity really. Sad & Pathetic even. Shysters & Poobahs or is it Sock-Wranglers & Pie-chart-interferers? Nah, its Shite & its avoidable Pish.

Saturday, 1 December 2012

I was a zombie garden centre

One of the first things I did in banking was

assess a credit application for a garden centre. Discussing the business with a

more experienced colleague, he pointed out the owners would be

better off selling it, paying off their debts and sticking what was left in a

savings account judging by how much they actually took out the business to live

on. Later, I looked at a credit for a farm. Reading the file I discovered

the farmer had been struggling to make it pay for years so every so often had sold

off assets to manage his debt; a field here, a tractor there until eventually he

moved into a static caravan andm sold his

house.

Picking out the general features of these examples provides

a reasonable definition of a zombie company, it being one that

generates a poor absolute and/or relative return on capital, has negligible

prospects as it stands and is barely, if even, able to meet its existing financial

obligations without gradually cannibalising itself; zombie companies exist rather

than prosper. Moreover, when/if we ever move out of the current low-low interest

rate regime many of them will finally expire.

I’m putting this definition forward in response to the growing interest

in zombie companies. A recent radio 4 File on 4 on the subject made for

interesting listening and included chats with some highly relevant people (and some

others as well), but ultimately proved analytically far less than the sum

of its parts largely because of its half-arsed "Austrian" capital mis-allocation aspects (much of this being provided by Jon - can the BBC please start calling him the private equity boy that he is and not an entrepreneur - Moulton for some reason). Despite this, the Treasury Select Committee subsequently saw fit

to raise the subject, choosing once again to highlight its

largely facile nature.

Here’s why; the concern with zombie companies stems mostly from the Japanese lost decade. Rather than ‘fess up to problem loans,

Japanese banks opted to extend them on the basis that a rolling loan gathers no loss.

The only problem with this is a bank can only lend so much and if a big chunk

of its lending is tied up in companies that aren’t going to grow or are problem

loans involving undeclared losses, then more viable businesses get starved of credit, economic growth is

impacted, ya de ya de yada.

Fast

forward to the here and now and you’ve the Bank of England (BoE) getting all

concerned about forbearance, meaning they’re concerned British banks have turned Japanese and opted to roll loans rather than ‘fess up to all the dreck

on their books so as to avoid even bigger losses. This concern has taken an

aggressive turn with the publication of the BoE’s latest FinancialStability Report, which explicitly goes on (and on) about Forbearance and how

“the longer it continues, the more likely it is to be concentrated on weaker

companies with less ability to invest and innovate. This might divert credit

from potentially more productive companies, for example new business

start-ups.”

Unfortunately, dull facts prevent any direct comparison between Britain

and Japan being especially meaningful.

Drat. One is the Japanese experience was predicted on fundamental

differences in the structure of their economy, in particular the prevalence of

keiretsus, groupings of companies spanning various industries typically centred

on a bank and defined by cross-shareholdings and close familial relationships.

Or as a Japanese bloke I knew explained when his family’s firm was invited

to join a keiretsu, him marrying a senior banker’s daughter would seal the

deal. So when a Japanese bank rolled the loan of a zombie company, there’s a

good chance it was a father helping out his son-in-law at a company he part

owned. By contrast the structure of the British economy just isn’t like that meaning

it lacks the obvious incentives seen in Japan to prop up zombies. Another

thing to bear in mind, given preserving Britain's AAA status is a lynchpin of current economic policy, is that when the Japanese banks finally started ‘fessingup to what they were doing, calling up securities and so on, taking the pain and

finally declaring the losses that had been sat on their books for years, Japan

was downgraded by the rating agencies.

Yet another

thing is what the British banks have actually been doing. Here the BoE

stability report helps by stating “the non-core disposal plans of LBG and RBS

are ahead of schedule and targets for 2012 have been raised. Since 2008, these

banks have shed £383 billion of assets”. Now just chew on that for a minute,

£383bn. They have already disposed of assets i.e. loans valued at £383 billion and are

due to get rid of even more. Fuck me.

To

put that in perspective you could compare £383bn to the all new £3bn Green

Investment Bank, except that would be to show up the latter's mediocrity. So

here’s a better comparison; the total assets of the entire British building

society sector as at June 2012 i.e. how much it’s lent, were £325bn. So between

them LBG and RBS have already got rid of far more “non-core” assets than the current

British building society sector has acquired in over 100 years. And the “non core” bit is important because it includes

exactly the dreck the Bank of England is concerned about/Japanese

banks once kept on their books.

Except

perspective seems to be missing judging by the stability report’s chat about he

European Banking Association’s findings on forbearance given this includes the

"interesting" Spanish bank experience, which can be summed up as pantalones en el fuego liar liar, when it comes to their annual accounts and the losses they’ve been

willing to declare.

Aside

from these dull facts there’s the slight issue of monetary policy and the chat about how

when interest rates start edging back to more normal levels,

all the zombie companies currently being propped up will start keeling over, stifling any

recovery. Except, one, the BoE is maintaining interest rates at record lows and

two, via the funding for lending scheme, is inventing entirely new ways of

cutting credit costs i.e. the institution doing more than any other to actively

prop up zombie companies is the same one going on about them being a bad thing.

So “What is to be done?” Well, this is the bit that needs spelling out very clearly - British banks are now being encouraged to start pulling the plug on thousands of businesses more aggresively than they already are.

This is a fucking stupid notion for all sorts of reasons.Practically, how the fuck does a bank know which business is a Facebook and which a Myspace let alone a FriendsReunited (besides which Facebook has already jumped the shark)? Anyone with that kind of Nostrdamus like insight would already have invested in the winner and retired somewhere lovely.

This is a fucking stupid notion for all sorts of reasons.Practically, how the fuck does a bank know which business is a Facebook and which a Myspace let alone a FriendsReunited (besides which Facebook has already jumped the shark)? Anyone with that kind of Nostrdamus like insight would already have invested in the winner and retired somewhere lovely.

Politically, just think about it

for a mo; zombie companies are servicing their debts, meeting their covenants

and getting by doing their thang, then allova sudden a big evil bank pulls the plug cos its

decided the customer doesn’t have a business model with exponential growth

potential. Uh huh? And how much of a backlash would that generate? Like to get

a sense of how cretinous the reporting on bank lending already is ignore the routine

bollocks criticising banks that only sell debt for not providing start-ups with equity and read the following monumentally shite article; “Lending from RBS and Lloyds slumps by £117bn in less than three years” i.e. banks are

already being criticised for doing what the BoE wants them to do.

Then there’s the economic impact; the

main problem facing the British economy right now is a crisis of demand

influenced by factors including falling real incomes and a lack of confidence.

Now, would banks pulling the plug on thousands of businesses sort that out? Of course it wouldn’t, instead it would aggravate it, a lot, and that's without

taking into account the potential impact of an asset fire sale. Like even accepting all these start-ups i.e. tiddlers, are being starved of debt, that’s

so existing businesses can keep employing people and buying goods and services.

Like see that hand, the one with a bird in it? Cool, that’s what we’ve got right now and its worth a damn sight more than the two that may or may not be in a

bush in 5 years time. Oh and then there’s the potential for companies to suddenly

shit themselves/rein in spending even more than they already are when they realise banks are more

likely to pull the plug.

Finally, there are the examples I

started with and what they actually mean. The reason the farmer struggled on

was so his eldest son could inherit some land and maintain a family tradition. Similarly, as for the garden centre, who the fuck is the BoE, the current fiscal policy in favour of bunch of cock that it is, to strong-arm anyone, tax payer owned bank or otherwise, into

destroying a business a husband and wife had built from scratch and were continuing to make

a living from?

Tuesday, 16 October 2012

Tax americano

http://www.youtube.com/watch?v=3w4tcIsaInE&playnext=1&list=PLCZfzhrOFoIpCxLDFLBOM7OH-c6q9ya97&feature=results_video

I remember listening to some Labour MP a couple of years back arguing against some factory closing. As she wittered on about how the factory was still profitable so shouldn’t be closed I remember “wisely” thinking, that’s as maybe, however, it wasn’t profitable enough what with things like hurdle rates and acceptable returns on equity to consider. What reminded me of this is the chat about Starbucks paying just £8.6m in corporation tax over 14 years on over £3bn in sales or 0.29%. Now THAT is taking the piss.

I remember listening to some Labour MP a couple of years back arguing against some factory closing. As she wittered on about how the factory was still profitable so shouldn’t be closed I remember “wisely” thinking, that’s as maybe, however, it wasn’t profitable enough what with things like hurdle rates and acceptable returns on equity to consider. What reminded me of this is the chat about Starbucks paying just £8.6m in corporation tax over 14 years on over £3bn in sales or 0.29%. Now THAT is taking the piss.

It doesn’t actually matter what Starbucks or Her Majesty’s

Revenue and Customs say, that is taking the piss. If the taxes paid reflect

what Starbucks’ actually makes in Britain, then it is a profoundly incompetent business and the

CEO and board should have been dismissed years ago for wasting shareholder

funds on such a cack venture. If the business is as profitable as Starbucks actually

tell investors (or they’re lying and therefore not fit to remain in place) and its

all perfectly legal, then the laws governing corporation tax are profoundly flawed

and/or Revenue and Customs are either bent or profoundly incompetent.

So there you are then, either:

1) The

Starbucks executive is profoundly incompetent

2) The Starbucks executive tells massive porky pies to people it shouldn't

2) The Starbucks executive tells massive porky pies to people it shouldn't

3) HMRC

is bent

4) HMRC

is useless

5) Corporation

tax laws are useless/are easy to game by tax bods

You choose. Personally, I reckon a big dose of 5 most likely applies from which a couple of things flow, like Starbucks ability to game tax laws gives it a major competitive advantage - coffee tastes like shit? Who cares, Starbucks has the best tax experts so that’s what you’re stuck with – which in turn means we as consumers are more likely to be lumbered with it in perpetuity.

But, I reckon there’s an easy response at hand. Looking at how

America

periodically brings the multi-multi-million fine hammer down on business, as a

mate has frequently pointed out, a big factor underpinning its ability to do so is access to its domestic market. Basically, as Standard Chartered recently learned,

the American approach is this:

1) We’ve

caught you doing something we reckon is a bit naughty

2) Because

of that we are going to fine you. Big time.

3) Don’t

like that? Is it an ickle bit hurty?

4) Pay up or we’ll lock you out the US market. Bitch.

By contrast the British approach has been a tad more obsequious

as in every time anyone asks a multinational company or just an employer with

a mind to outsource stuff, for well anything really, the response has been shut

up or we’ll export everything including our head office to Poland, Ireland, Monaco, India, Indonesia etc.,

Except, this doesn’t apply to Starbucks. Or McDonalds. Or

KFC. Or Top Shop. Or Tesco etc., Each of these companies – or at least the

British bits – are wholly dependent on having “boots on the ground” on a high

street near you; until someone invests a 3D printer that does lattes, they simply

can’t outsource their outlets.

What this means is straightforward, we have them by the

balls, so perhaps, given the extent to which Starbucks has taken the piss, we

should start squeezing them.

Now, one option would be to rewrite or add to the existing

corporation tax bible. Except doing so would be a mistake. It would be

cumbersome, it would take up loads of time and money and, most importantly, it would be gamed. So

don’t. Seriously, don’t.

Instead, in this era when the high streets at the heart of every community are becoming increasingly generic, PLC dominated statements of consumerist anonymity, introduce a high street regeneration fund financed by a levy of say £10,000 paid for each outlet operated by businesses running more than say a 100 in the UK (for the same notion being proposed in a different context, see here).

Instead, in this era when the high streets at the heart of every community are becoming increasingly generic, PLC dominated statements of consumerist anonymity, introduce a high street regeneration fund financed by a levy of say £10,000 paid for each outlet operated by businesses running more than say a 100 in the UK (for the same notion being proposed in a different context, see here).

Would this chase British jobs overseas? Nope, as has already

been said you can’t outsource a Starbucks.

Would this penalise Small to Medium sized businesses (SMEs)?

More than a 100 branches and you’re claiming you’re an SME? Piss off. Besides

the 100 is relatively arbitrary.

But, all these companies already pay council taxes and what not making this unfair - pretty much every business pays council taxes, but, typically, only da big boys can afford entire tax dodging departments, hence an additional levy targeted at them would make things far fairer than they currently are.

But, all these companies already pay council taxes and what not making this unfair - pretty much every business pays council taxes, but, typically, only da big boys can afford entire tax dodging departments, hence an additional levy targeted at them would make things far fairer than they currently are.

Ahh, but what if Starbucks closed branches as a result? So what, the

smaller companies that already pay more tax would quickly fill the gap so we'd still be quids in. Heck they could simply buy up empty Starbucks premises given they were in already proven locations.

Will this push Little Chef over the edge? I guess,

but given that’s been aggresively rogered by private equity for years and is cack who cares,

plus it would engender more SMEs, more competition and better quality by taking

away the competitive advantage big businesses have that stems purely from them

being able to afford more tax experts than a much smaller rival that potentially sells much better coffee.

Ahh, but this would see businesses stall at 99 branches

whereas we need national champions - nothing is perfect in this life so grow

up, plus if you’re that big chances are you’ve got more than a few tax experts

on the payroll already.And as I said the 100 is relatively arbitrary.

Besides, given Starbucks currently runs 735 outlets I reckon

the additional, annual tax take of £7.4m vs the £8.6m they previously paid over

14 years is worth it. Actually feck £10,000, make it £20,000 or floor space

related or something to catch Tesco, but you get the basic drift here –

introduce an additional, retail outlet focused charge (i.e. a tax) designed to

catch the tax efficient big boys. Above I suggested using some mince about high street regeneration as an excuse/cover, but heck call it the Starbucks levy for all I care. As for what it

would pay for, that’s easy, mad stuff like school books.

An October 22nd P.S. You could argue this would penalise big companies that do play fair with their tax returns. You could, I wouldn't because in practice am guessing what playing fair most likely means here is not taking as much piss as Starbucks. Besides, what I'm suggesting would reduce their taxable profits i.e. on a net basis it wouldn't have that much of an impact on them. Anyway, the issue here is the British accountancy profession and Starbucks. Blame them.

Another thing is the suggestion I read today about having Starbucks up in parliament to explain themselves. This would be a distracting waste of time. MPs would huff and puff, senior tax bods would similarly puff and huff and Starbucks would say:

1) Its all perfectly legal and signed off by tax inspectors - which isn't the point. The point is they're taking the piss. That and as current tax law isn't working, then current tax law needs to be bypassed via a more striaghtforward approach - as people say, when you're in a hole, stop digging.

2) Then they'd most likely trot out how much income tax, national insurance, council tax and what not they pay - to which the response is so does every other company AND they pay corporation tax too ya twat. There's presumably also scope here to get really evil and compare/contrast all those things as a % of their turnover with a rival to see if they're gaming those taxes as well.

2) Confronted by that they'd most likely do some corporate social responsibility mince - which highlights how that's used to paper over/legitimise what businesses actually do, isn't compulsory and is besides the point which is Starbucks is taking the piss with their tax returns.

A 12/11/12 P.S. Wow. Now that Amazon, Google and Starbucks have been had up before some MPs the truth will out it seems. So whereas there was me thinking it was the shitness of the UK tax laws and the general ability of tax lawyers and accountants to circumvent them that was the issue, actually, for Starbucks its the fact they don't make money here - despite what they've said to their investors i.e. they are liars and shite at business.

But, MPs showboating does fuck all beyond feed MP egos and give the impression that something is being done. Some practical steps are needed and here, rather than the levy I thought was the thing to do, the former Labour government bod Lord Myners nailed it when he said a sales tax should be introduced, that being a means of catching online bods as well as coffee shops without wasting any time fannying about with HMRC.

Good. Introduce it. Now. And do so bearing in mind the Scottish levy on fag sellers that targets larger businesses e.g. it doesn't appear to be against the law to target specific business types. Heck, the criteria for what type of annual accountsa business needs to get done has made that clear for years.

The Starbucks boy was fun though, him and his bullshite (and of course they've talked up how much tax e.g. VAT, national insurance etc. they pay as if complying with the law was a big deal and as if every other business didn't already do so. Go home ya Ummurkan scum).

An October 22nd P.S. You could argue this would penalise big companies that do play fair with their tax returns. You could, I wouldn't because in practice am guessing what playing fair most likely means here is not taking as much piss as Starbucks. Besides, what I'm suggesting would reduce their taxable profits i.e. on a net basis it wouldn't have that much of an impact on them. Anyway, the issue here is the British accountancy profession and Starbucks. Blame them.

Another thing is the suggestion I read today about having Starbucks up in parliament to explain themselves. This would be a distracting waste of time. MPs would huff and puff, senior tax bods would similarly puff and huff and Starbucks would say:

1) Its all perfectly legal and signed off by tax inspectors - which isn't the point. The point is they're taking the piss. That and as current tax law isn't working, then current tax law needs to be bypassed via a more striaghtforward approach - as people say, when you're in a hole, stop digging.

2) Then they'd most likely trot out how much income tax, national insurance, council tax and what not they pay - to which the response is so does every other company AND they pay corporation tax too ya twat. There's presumably also scope here to get really evil and compare/contrast all those things as a % of their turnover with a rival to see if they're gaming those taxes as well.

2) Confronted by that they'd most likely do some corporate social responsibility mince - which highlights how that's used to paper over/legitimise what businesses actually do, isn't compulsory and is besides the point which is Starbucks is taking the piss with their tax returns.

A 12/11/12 P.S. Wow. Now that Amazon, Google and Starbucks have been had up before some MPs the truth will out it seems. So whereas there was me thinking it was the shitness of the UK tax laws and the general ability of tax lawyers and accountants to circumvent them that was the issue, actually, for Starbucks its the fact they don't make money here - despite what they've said to their investors i.e. they are liars and shite at business.

But, MPs showboating does fuck all beyond feed MP egos and give the impression that something is being done. Some practical steps are needed and here, rather than the levy I thought was the thing to do, the former Labour government bod Lord Myners nailed it when he said a sales tax should be introduced, that being a means of catching online bods as well as coffee shops without wasting any time fannying about with HMRC.

Good. Introduce it. Now. And do so bearing in mind the Scottish levy on fag sellers that targets larger businesses e.g. it doesn't appear to be against the law to target specific business types. Heck, the criteria for what type of annual accountsa business needs to get done has made that clear for years.

The Starbucks boy was fun though, him and his bullshite (and of course they've talked up how much tax e.g. VAT, national insurance etc. they pay as if complying with the law was a big deal and as if every other business didn't already do so. Go home ya Ummurkan scum).

Labels:

corporation tax,

starbucks,

tax dodging,

tax efficiency

Thursday, 4 October 2012

Fandabi-pish

PICTURE TO FOLLOW

On reflection mebbe Spod Miliband’s appropriation of

rhetoric first popularized by a dead Tory wasn’t that impressive. I mean

just the other night you had Mitt-trickle-down-economy-Romney use the makey-uppy

term “trickle-down government” pejoratively. Now I’ve no idea what this means,

but it does suggest stealing a political opponent’s rhetoric, then using it aggressively

enough to distract from the fact doing so renders it gibberish is the thing to

do. Heck, even Scottish Labour is in on the act.

The context for this rhetorical, tartan land grab is the downward trajectory seen in the calibre of Scottish Labour party

leaders since Donald Dewar where latterly, Wendy Alexander aside, we've seen Iain

Gray (who?) give way to the wonder that is Johann Lamont (as in you

wonder how she’s ended up where she is). Now to be fair, you’d be a fool to expect much off such a mediocrity, but, the degree of bile dripping off her “something

for nothing” chat does merit some attention.

So whereas in the past “something for nothing” was what you’d hear a New Labour or Tory bod say about people living on benefits before

trying to cut said benefits, for Johann it's the following who get “something for nothing”:

- “a banker on more than 100,000 a year benefitting more than a customer on average incomes from the council tax freeze

- a chief executive on more than 100,000 a year not paying for his prescriptions

- judges and lawyers earning more than 100,000 a year, not paying tuition fees for their child to follow in their footsteps at university”

Whit? Add accountants and doctors to this list and you’d have a professional full house, except how do any of the above get “something for nothing” given they all typically pay significantly more in tax than they ever receive in state benefits and services?

The answer is they don't rendering Johann's “something for nothing” inaccurate bollocks. And practically, excluding the above from benefits would require the introduction of means testing, which would mean the following:

- Creating a big, inefficient (think tax credit over/under payments), taxpayer funded bureaucracy to administer it

- Unintended consequences i.e. people not claiming what they’re due en masse and the resultant suffering this would induce

- All sorts of destructive disincentives e.g. why save for old age if it’ll just get taken off me

- A frontal assault on universalism, the encouragement of individualism and the associated ghetto-isation of previously universal benefits with all that entails.

That’s just dull practical stuff though to be simply ignored judging by Johann's repeated references to having patronised care workers in the interviews she's been giving, this seemingly providing a sharp, "werking class" contrast to the "something for nothing" types listed above. Politically, this is a shame because it leaves her chat coming across like a blinkered, us and them alienating, nasty retreat into Labour’s West of Scotland heartland. One nation? Nah, not unless it’s the Kingdom of Strathclyde.

The tragedy here is that an alternative, positive

rhetoric is readily available, one that accepts universalism as a positive given that embodies the Scottish electorate’s social-democratic

bias. Adopting this alternative would easily shift the focus

away from debating who should or shouldn't get a free bus pass towards how to pay for these things. So here goes; you could talk about how we’re all in this

together then argue that to avoid introducing tuition fees, you’d need to retain

the 50% income tax rate in Scotland

and introduce wealth taxes or at least fairer council taxes.

I’m game for this despite being part

of the “something for nothing” class. It’s just doing so would be to effectively argue in favour of independence

or at least devo-max. As this appears unthinkable for Labour its instead chosen to have some mealy mouthed

joke of a Jimmy Krankie looky-likey talk inaccurate, vitriolic pish.

Tuesday, 2 October 2012

Get tae Bradford

Setting aside the perfectly poised hand gestures and demographically precise bods sat in the background as backdrop, the Ed Miliband speech was excellent. I mean c'mon it claimed/re-worked a distinctively and impressively British ideology.

That this reworking of a historic political stance followed Eric Hobsbawm's death, a fella with links to Ralph - dad of Ed and Dave - Miliband, again emphasised the sense of a distinctive, yet deep rooted British tradition of (potentially) radical politics.

But ...........the guy's a spod who should FOAD so his brother can take over. That's politics.

That this reworking of a historic political stance followed Eric Hobsbawm's death, a fella with links to Ralph - dad of Ed and Dave - Miliband, again emphasised the sense of a distinctive, yet deep rooted British tradition of (potentially) radical politics.

But ...........the guy's a spod who should FOAD so his brother can take over. That's politics.

Friday, 14 September 2012

Historicism

Whoever said the lesson of history is that there are no

lessons was an arse. Mark Twain on the other hand is supposed to have said “The past does not repeat itself, but it rhymes”, which rocks.

To be fair, the work chat I mind from a couple of years back was that business cycles last 6 years; 4 to learn the lessons of the last disaster and another 2 to forget them. This implies that in banking, greed, arrogance and stupidity are both timeless and recurring. Given that, let’s compare and contrast what happened to the bods who knacked the City of Glasgow Bank with today’s high flying “wealth creators”.

As if to emphasise the difference between then and now, the late historian Sydney Checkland described the City of Glasgow Bank’s board when it failed as “mediocrities and men of straw”. All of them, plus the Bank’s manager, were soon had up before the High Court in Edinburgh, found guilty of various offences and given jail sentences ranging from 8 to 18 months. Thankfully, today’s “wealth creators” are treated with much more respect; when they go a tad awry, the worst they can expect is a fine equal to only a fraction of their personal wealth or the loss of a knighthood, but prison? Heaven forbid.

To give one example, there’s that Scottish bank run disastrously

into the ground by its West of Scotland executives who, speculating on asset

values, lent too much to too few people while taking no where near enough security

to protect their company’s interests. Obviously, I’m talking

about the 1878 failure of the City of Glasgow Bank. Obviously. Since then banking has become a much, much more sophisticated activity and no banker would ever be fuckwitted enough to adopt a similar “business model", give or take the ones that have.

To be fair, the work chat I mind from a couple of years back was that business cycles last 6 years; 4 to learn the lessons of the last disaster and another 2 to forget them. This implies that in banking, greed, arrogance and stupidity are both timeless and recurring. Given that, let’s compare and contrast what happened to the bods who knacked the City of Glasgow Bank with today’s high flying “wealth creators”.

As if to emphasise the difference between then and now, the late historian Sydney Checkland described the City of Glasgow Bank’s board when it failed as “mediocrities and men of straw”. All of them, plus the Bank’s manager, were soon had up before the High Court in Edinburgh, found guilty of various offences and given jail sentences ranging from 8 to 18 months. Thankfully, today’s “wealth creators” are treated with much more respect; when they go a tad awry, the worst they can expect is a fine equal to only a fraction of their personal wealth or the loss of a knighthood, but prison? Heaven forbid.

Another difference between then and now was that the City of Glasgow failure taught the late

Victorian bourgeoisie the limitations of unlimited liability; because it was an unlimited concern the Bank's 1,819 shareholders were liable for all of its obligations and after these were met, only 254 of them remained solvent. Funnily enough, the City of Glasgow Bank failure was

followed by a new Companies Act in 1879 and with it the widespread adoption of

limited liability; unlimited liability, or what a Vince Cable might call shareholder activism, having previously been regarded as a built-in

check on management, was suddenly recast as a barrier to investment and as such something

to be got rid of pronto for the good of the economy.

Fast forwarding to today, rather than any change sensibilities, I'd argue the structural changes made to the financial obligations of asset owners/shareholders (i.e. the rich) underpin the change in how “wealth creators” now get treated. Then, shareholders got fucked. Now? It’s the taxpayer. Then, the

people who ran banks that fucked up and fucked the finances of

the rich got the jail. Now? Less so. See the difference?

As for the rhyme, it sounds like Berkshire Hunt(s).

As for the rhyme, it sounds like Berkshire Hunt(s).

Wednesday, 12 September 2012

Peter C

The FSA judgement on Peter Cummings is interesting for all sorts of reasons, notably its fundamental flaws. Cummings' repugnantly unrepentant whine, as quoted in a BBC article is also interesting; "(f)or the past three and a half years I have been singled out and

subjected to an extraordinary Orwellian process by an organisation that

acts as lawmaker, judge, jury, appeal court and executioner."

That Cummings appears aware of how organisational power can enforce a worldview wherein 2+2 = 5 is a revelation, but am guessing he actually meant Kafkaesque. Am also guessing he doesn't know any better. Ignorant dick.

That Cummings appears aware of how organisational power can enforce a worldview wherein 2+2 = 5 is a revelation, but am guessing he actually meant Kafkaesque. Am also guessing he doesn't know any better. Ignorant dick.

Tuesday, 11 September 2012

Where's it gone?

Is this it here? Have you looked under there? On top of

that? Nope? Then I don’t know either. Do you know where the threats British

banks made to relocate overseas in response to potential regulatory changes

they didn’t like have gone?

They definitely used to be here, like they were very loud and clear and deliberately made part of the bank regulatory reform debate. And

there were loads of them as well; HSBC (the drug barons’ bank of choice) had

one, so did Barclays (Libor rigging) and Standard Chartered (Iranian sanctions?

Pfff).

Yeah it is weird. Like when Barclays was subsequently forced to change its utterly irreplaceable CEO, you'd have thought that would have prompted a mass exodus overseas.

Was it the implicit government subsidy/insurance policy

other countries wouldn’t be able or willing to provide that proved too big a

barrier? Or was it the reality of not having UK regulators to back them up when

the Americans got a hold of their nads that prompted second thoughts? Mebbe it

was only ever disingenuous sabre rattling that was taken too seriously by

politicians/media too used to the old approach of banks get what they want or

else(!).

So yes there is the positive here of this loss signalling the terms (or at least the rhetoric) of the debate have changed, but its still a fundamental shift in policy that perhaps the next big bank bod to be questioned could explain. Oh hang on, the

other thing we’ve lost (assuming we had it in the first place), is a practical

memory when it comes to things like this.

Saturday, 8 September 2012

None so blind as those who will not see

So why exactly does the BBC go SOOO easy on, to the extent

of misrepresenting, the American right?

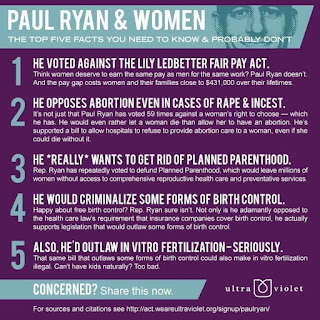

Partly, I think its because nasty bastards like Paul Ryan

are only ever found on the extreme fringes of British politics so when the BBC

is confronted by what he actually believes in, says, votes and campaigns for,

they instinctively assume he’s not being serious and selectively

tone down how he’s portrayed into something it finds more palatable.

The other thing is the BBC is lazy and relies on predictable

tropes for communicating the news. When it comes to America this means viewing

everything in terms of the “special relationship”.

Practically, this involves producing stories that:

-

exaggerate the importance of the UK to the US as a strategic partner

-

exaggerate the influence the UK

has on the US

-

exaggerate the attention paid by US politicians and the

US public to the UK, its politicians and the Royal family

-

downplay the extent to which the UK is just another mid-size

economy/political player

-

downplay the extent to which UK support is taken for granted

Then on the back of this periodically debating whether there

still is a “special relationship”, its costs/benefits, producing documentaries

that examine it (all predicated on the assumption that there is one) and so on.

The problem Paul Ryan poses here is straightforward;

no one wants to be a relationship with a nasty mentalist, special or otherwise.

To actually produce accurate reports would expose this. The BBC

response? To provide only biased and highly selective accounts that leave deluded notions

of the "special relationship” intact by leaving out the batshit crazy nasty

aspects of actual Republican politics.

Labels:

bbc,

biased reporting,

media bias,

paul ryan,

the special relationship

Monday, 3 September 2012

A dignified part

A

cool thing about America

is how looking at stuff there gives an insight into how shit is/will be here

in an if only I could see myself how others do style. Not everything of course,

but some good ‘uns, my personal favourite being the Military Industrial Complex

(MIC).

The MIC is so popular with the US left it figures in “pop” songs. Calling it out highlights the actual relationship between private military contractors and the state and how the former lobbies for increased defence spending, using the profits this generates to grease the revolving door between the two that sees officials responsible for spending taxpayer monies subsequently taking up well paid jobs with contract winners on a regular basis.

The MIC is so popular with the US left it figures in “pop” songs. Calling it out highlights the actual relationship between private military contractors and the state and how the former lobbies for increased defence spending, using the profits this generates to grease the revolving door between the two that sees officials responsible for spending taxpayer monies subsequently taking up well paid jobs with contract winners on a regular basis.

So the

MIC draws attention to the vested interests and general bentness of government

spending. Obviously nothing like that happens here what with our civil service

having a deep and profound public service ethos give or take the PFI/PPP

private sector bods who advise government on err PFI/PPP, the Ministry of

Defence bods who get jobs with BAE etc., etc., ....

Actually, this reality prompts questions about why we tend to delude ourselves about such obvious bentness given how much raw vested/self-interest figures in our lives as well. Am guessing it's because we remain suckers for the “dignified part” of the constitution Walter Bagehot went on about and kid ourselves its all fair play and a good innings ya de ya di bollocks. Like click here for a wonderfully naive example of some middle class English bod placing as much faith in the power of "independent" truth as an attorney played by Julia Roberts would in a Hollywood shitfest.

Actually, this reality prompts questions about why we tend to delude ourselves about such obvious bentness given how much raw vested/self-interest figures in our lives as well. Am guessing it's because we remain suckers for the “dignified part” of the constitution Walter Bagehot went on about and kid ourselves its all fair play and a good innings ya de ya di bollocks. Like click here for a wonderfully naive example of some middle class English bod placing as much faith in the power of "independent" truth as an attorney played by Julia Roberts would in a Hollywood shitfest.

That

aside the interesting thing right now is how little liberal American critiques

of the American polity and the American right appear to be resonating here

despite the reality. Starting with the polity, it’s the whole Washington is in its Wall Street paymasters’

pockets due to the reliance of politicians on political donations thang. Here?

Ach, its totally and completely different, like “Under Cameron, forexample, the proportion of Conservative Party funding derived from the Cityrose by 25% in five years to make up 50.8% of the Party’s total – 27% of thiscame from hedge funds and private equity”. Oh. Oh dear.

But, hey that’s just cash

for "dignified" knighthoods isn’t it, like it’s not as if financiers are backing up the

influence and access their money gives them with policy ideas by promoting and supporting think

tanks and policy proposals? Like its no as if 6 board members of

the Tory Centre for Policy Studies think tank are bigwig fund managers, investment bankers or private

equity bods. Oh, they are? And the only significant industry grouping on its

board is finance with no other industry or sector having any meaningful

representation whatsoever? Really? Oh.

Here, lets look at the BBC coverage ofPaul Ryan’s conference speech where he told a run of absolute, blatant whoppers to the extant that some US bods are now talking about “post-truth” politics wherein, contra Matthew Parris, politicians tell humungous porky pies the media doesn’t bother to check.

Thankfully the Beeb in its lovely and objective way called him out every time by referring to Ryan’s speech/whopper list as having contained some “alleged inaccuracies” (?), “errors”(?) and that for some he was “slack with his facts” (WTF?) and was open to the charge of “misleading his audience”. Oh. No, not really, rather he told a run of utter whoppers, like UTTER whoppers with them and the marathon time thang indicating he’s got a pathological aversion to anything not in keeping with his worldview/public image.

Oh dear. This example actually suggests that when a US politician on the right lies thru his pants in public, his recent personal association with efforts to get utterly revolting notions of rape built into US law gets forgotten by our licence payer funded journalists because they're too busy twisting themselves in semantic knots trying to tone down his tendency to tell utter whoppers. Oh dear 2x.

Again the short-term question this prompts is why. Longer term, given Labour has already half-inched loads of Obama rhetoric, it’s whether in an era when the financiers that fucked the UK economy still have an obviously disproportionate influence over the UK polity in ways that reek of hotdogs, we’re also heading towards a post-truth politics. That or whether we’re already there.

Labels:

bbc bias,

bbc news,

british politics,

paul ryan,

Tory funding

Tuesday, 24 July 2012

Northern Shock

* "sell-off nets extra £538m for taxpayers" - I saw this headline in an article on the sale of Northern Rock and thought cool.

It stems from Virgin buying a further £465m of Northern Rock's mortgage assets and agreeing to pay an extra £73m in cash for the bit it’d already bought for £747m. Which is lovely and straightforward; 465+73=538. That plus 747 gives £1,285m doesn’t it? Except “UKFI has estimated that the government could ultimately receive more than £1bn” vs the original £1.4bn invested in it by government on the taxpayer’s behalf.

This left me confused, like where’s the extra £285m gone then? Best to head over to the National Audit Office (NAO) report on all this and see what its saying.

It stems from Virgin buying a further £465m of Northern Rock's mortgage assets and agreeing to pay an extra £73m in cash for the bit it’d already bought for £747m. Which is lovely and straightforward; 465+73=538. That plus 747 gives £1,285m doesn’t it? Except “UKFI has estimated that the government could ultimately receive more than £1bn” vs the original £1.4bn invested in it by government on the taxpayer’s behalf.

This left me confused, like where’s the extra £285m gone then? Best to head over to the National Audit Office (NAO) report on all this and see what its saying.

Ahhhhh, I see. The main NAO focus was on whether the Virgin deal represented value for money for the taxpayer, what with Northern Rock having been split into a good bank and a bad bank (the good bank being the bit Virgin bought). And aye weren’t there suspicions (and chat) at the time that it got a bargain what with it getting “Customer accounts of £21 billion matched by £10 billion higher-quality mortgages and £11 billion cash” for £747m?

Well the NAO think the Virgin deal was good value because Virgin paid 80-90% of the good bank’s book value at a time when the market prices for major UK banks was around 50 per cent of book value. Crikey, that does sound good.

Its just, its just …… the Northern Rock bit that got sold was in no shape or form comparable to a major UK bank; its an apple and they’re all oranges give or take the odd lemon. Like (1) It has a “clean” mortgage book made up only of the good stuff i.e. it involves a lower risk of future losses than the mortgage portfolios of any other major bank (2) It’s a purely retail i.e. mortgage bank, so is and is likely to remain far safer than any of the universal portfolios major UK banks actually have i.e. there’s none of the corporate, by which I mean the leveraged finance and commercial property, dreck that have been and remain the primary drivers of UK bank losses. And (3) its no exposure to the Eurozone with all the risks (and associated losses) that entails. So too bloomin’ right it should have been sold at a significant premium to other major UK banks.

The other thing is the reference to the sale transferring billions and billions of cash. I’m not sure what that actually means like did Virgin pay £747m for £11bn in cash? If so I’d like some of that sweet, sweet action. Alternatively, it means that when it was sold Northern Rock had an incredibly liquid i.e. strong, balance sheet. Hence, this alternative report on the sale states Virgin got a “£14bn mortgage book” and “a £16bn retail deposit book”, which is a loan to deposit ratio of 88%. Crikey! That's low and again emphasises how the sale involved assets in no way comparable to other major UK banks.

And remember Northern Rock failed because it was overly, like MAD overly reliant on wholesale funding and had a loan to deposit ratio of something like I don’t know 20p in customer deposits for every £1 lent as opposed to the good bank’s eventual 16p for every 14p lent. So Virgin need only make modest tweaks to its new bank’s funding profile, shifting assets from no/low return highly liquid things into some-return less liquid things and it’ll increase its profitability in an instant. Hmmmm............

Then there’s the bad bank we’re still left with and its £54bn of mortgages that are being gradually wound down. This bad bank is so bad it made total profits before tax of £1bn in 2010 and 2011! And the increase in the return on the sale of Northern Rock stems primarily from the additional £465m in (profitable) mortgages sold to Virgin i.e. its not really that what Virgin paid for the good bank has increased, rather its paid out more for additiona assets that appear to be rather profitable. It’d also be interesting to know if Virgin buying these assets affects its loan to deposit ratio. It’d also be interesting to know if the plan here is to sell off more of the bad bank to Virgin in due course.

All this makes me wonder given it sets a precedent for the handling of the taxpayer’s remaining and far larger bank investments. Like based on the Northern Rock experience:

1)

Government appears

willing to sell early at a chunky loss

2) NAO assessments

involve some seriously spurious bollocks

3)

Sod it, why wasn’t

it held on to for a good few years more until market conditions for a sale had

improved with more money repaid in the meantime and the EU told, in a French accent, to stick their December 2013 deadline somewhere Greek

4)

The reporting of

this is pants, being either inconsistent, incoherent or both; like where’s this

extra £285m gone then and can a distinction between the sale price and any cash generated via subsequent (and additional) asset sales no be made?

* apologies for the obligatory Northern Rock bank run piccie

* apologies for the obligatory Northern Rock bank run piccie

Monday, 16 July 2012

Sharclays

I mind a colleague far better versed in the ways of “The City” than me referring to Barclays as Sharclays. I also mind someone I worked with heading off to work there, in BarCap to be precise. What made this bod memorable was that he was well known for being an arse and generally useless; last I heard he was doing rather well thank you very much. So really, the libor scandal is all about one bank’s culture, that and a few rotten apples who have thankfully been resigned allowing the lessons to be learned following a root and branch review.

Except, it very bloody obviously isn’t. As the former Barclays Chief Operating Officer has just made perfectly clear – the Bank of England had a word with the former Barclays CEO who then had a word with the former Barclays COO, who then told the relevant people to game libor. End of *.

Now some context here would help; in 2007 and 2008 the slightest whisper about a bank prompted all sorts of speculation, panic and potential crises of confidence. In this atmosphere, a quiet, unrecorded word with terribly important executives made pragmatic, if not legal, sense; better a “cheeky” wee fix now than another part-nationalisation later.

Unfortunately, the US’s more robust approach to white collar crime appears to have got in the way. Hence, we have the spectacle of the Treasury Select committee huffing and puffing, the FSA and the Bank of England saying they knew something was not quite right over at Barclays and the BBC's strenuous efforts to very obviously skew, distort and disguise what happened.

Hence for Robert Peston, our very own voice of objective financial market reportage and reason, the former Barclay’s COO saying he simply did what he understood the Bank of England said they wanted is actually proof of “Barclays' 'culture of pushing the limits'. This in turn followed an earlier Peston post asking if the Bank of England boy involved was a “Victim of his own innocence?” an interesting question to ask of a fucking deputy governor of the Bank because it’s so very obviously, but distractingly stupid.

The real point is straightforward; the party line here is to manage, massage and manipulate the news in ways that avoid exposing the status quo and limit any investigation of what went on; the "narrative" here is that some blinking foreigner and a few dodgy cronies at a rogue institution, off their own bat mind, gamed an honourable British system. Saying this often and loudly enough should hopefully drown out all the British financial regulators phoning their American counterparts to say “would you please be a good chap and shut the fuck up.”

Why this all took place is understandable. Given it’s documented in emails, there’s little debate as to its substance either. What subsequent events say about the way things are reported in Britain, how they’re managed, like how the SFO only eventually decided to investigate a very obvious fraud, i.e. the way “the establishment” works is actually the real story.

* From memory Barclays distinguished between two phases of gaming the system. One, the earlier phase, was out and out bent . The above only refers to the second phase.

Except, it very bloody obviously isn’t. As the former Barclays Chief Operating Officer has just made perfectly clear – the Bank of England had a word with the former Barclays CEO who then had a word with the former Barclays COO, who then told the relevant people to game libor. End of *.

Now some context here would help; in 2007 and 2008 the slightest whisper about a bank prompted all sorts of speculation, panic and potential crises of confidence. In this atmosphere, a quiet, unrecorded word with terribly important executives made pragmatic, if not legal, sense; better a “cheeky” wee fix now than another part-nationalisation later.

Unfortunately, the US’s more robust approach to white collar crime appears to have got in the way. Hence, we have the spectacle of the Treasury Select committee huffing and puffing, the FSA and the Bank of England saying they knew something was not quite right over at Barclays and the BBC's strenuous efforts to very obviously skew, distort and disguise what happened.

Hence for Robert Peston, our very own voice of objective financial market reportage and reason, the former Barclay’s COO saying he simply did what he understood the Bank of England said they wanted is actually proof of “Barclays' 'culture of pushing the limits'. This in turn followed an earlier Peston post asking if the Bank of England boy involved was a “Victim of his own innocence?” an interesting question to ask of a fucking deputy governor of the Bank because it’s so very obviously, but distractingly stupid.

The real point is straightforward; the party line here is to manage, massage and manipulate the news in ways that avoid exposing the status quo and limit any investigation of what went on; the "narrative" here is that some blinking foreigner and a few dodgy cronies at a rogue institution, off their own bat mind, gamed an honourable British system. Saying this often and loudly enough should hopefully drown out all the British financial regulators phoning their American counterparts to say “would you please be a good chap and shut the fuck up.”

Why this all took place is understandable. Given it’s documented in emails, there’s little debate as to its substance either. What subsequent events say about the way things are reported in Britain, how they’re managed, like how the SFO only eventually decided to investigate a very obvious fraud, i.e. the way “the establishment” works is actually the real story.

* From memory Barclays distinguished between two phases of gaming the system. One, the earlier phase, was out and out bent . The above only refers to the second phase.

Labels:

bbc bias,

Libor,

libor scandal,

paul tucker,

robert peston

Saturday, 14 July 2012

Grecian 2000 (and 12)

Despite his being that peculiar thing, a Scottish Tory, listening to Professor Niall Ferguson’s last Reith lecture, I was taken aback at how gifted and charismatic a communicator he truly is. And he’s got good hair.

The arguments he made about the current situation? Meh. Actually, delete Meh and replace with “pandering to the preservation of elite self-interest despite that being at the destructive expense of society and the economy as a whole”.

Professor Ferguson, of Harvard Business School no less, is of course a very talented Scotsman on the make who has established himself as a (very) well paid ornament of the aforementioned elite. His claim that government borrowing and sovereign debt is a betrayal of future generations is a dangerous one because it provides something that sounds like an intellectual basis that the elite might not otherwise have(or not be able to communicate so articulately) for hacking back government spending. It’s also pants with Greece providing a good starting point as to why.

Greece’s problems stem from two interlinked failures. One, successive governments racked up wodges of sovereign debt to waste on deeply inefficient public sector spending. In this respect Greece seemingly exemplifies the kind of arguments Professor Ferguson made better than any other country. However, there was and is a second Greek failure; successive governments allowed the Greek people and Greek business to dodge taxes on an industrial scale - Greeks love dodging taxes even more than they do sodomy and plate smashing.

The thing is the two failures are deeply, unavoidably and fundamentally entwined, which is why Greece actually lends little support to Professor Ferguson’s argument; a government unwilling to raise revenues i.e. taxes, has to find the money from somewhere to prop up inefficient dreck like Olympic Airlines. Hence, the Greek sovereign debt crisis is as much about tax dodging as it is wasteful government spending because debt financed both.

And as the people with the most benefit the most from tax dodging, Greece’s tragedy is as much about the wealthy camouflaging their swimming pools to avoid flying tax inspectors as it is civil servants receiving bonuses every time they wiped their arses (there is one difference between the two groups of course; Greece’s elite has been busily buying up luxury London property, off-shoring as many Euros as possible in a wonderful statement of national pride and unity. By contrast the civil servants are getting humped).

So even if you accept the notion government debt robs a nation’s children of their future at some point in the, well, future, right now Greece actually exemplifies how debt was and is being used to maximise the incomes and wealth of today’s elite.

But, Professor Ferguson is a historian and historians like facts, so lets have some. In fact lets approach this like say a Sir Lewis Namier, a dead historian who emphasised the importance of self-interest, something Professor Ferguson is profoundly enamoured with; hence, a recent study found doctors and engineers are the worst (or is that most effective?) professions in Greece for tax dodging. Now guess which two professions are heavily represented in the Greek parliament? Yup, failed vets and grease monkeys.

This is interesting. This suggests an alternative model for understanding how shit got to where it is, one where in the West economic and political elites used both public and private debt to mask the incredible growth seen in economic inequality, finance tax dodging (or tax cuts in the US/tax “efficiency” here) and, by seemingly boosting the incomes of us plebs, distract from the profound failure of “wealth” or “job” creators to create wealth for anyone other than themselves.

And sticking with Sir Lewis a mo longer, if I was a rich man, right now (or a rich man’s ornament), in between the yubby dibby dibby and the biddy biddy bum, I’d be going on at great length about how public spending needs to be cut back, how sovereign debt is a terribly bad thing, balanced budgets, couldn’t run a business/ household like that, yadda, yadda, yadda (biddy bum) i.e. doing everything I could to draw attention away from how higher taxes on capital and profits could also sort out sovereign debt (a practical policy suggestion here being howzabout next time there’s an “amnesty” for tax dodgers hiding their money off shore, the threat is pay everything or go to jail).

Wednesday, 20 June 2012

Defender of the 1%

For me the biggest shock of Jimmy Carr’s tax “efficient” Barrymore moment has been discovering Rufus Hound has 628,440 followers on Twitter. I didn’t realise, give or take Alan Davies, that such a non-funny comedian could be so popular *.

Rufus Hound’s support for Jimmy Carr has been fun though. If you didn’t know any better you’d wonder when he said Jimmy “is a very nice man who works incredibly hard and has donated loads of money to good causes” if he was defending a paedophile caught with his cock in the cookie jar. And when he said “He's done absolutely nothing illegal”, that simply sidestepped the issue here which is fairness.

But, hey, that’s dead heavy, serious and highlights the intellectual vacuity of C list celebs whereas this is all about cheeky, cheeky comedy chappies who never lick the arses of more popular bods to get regular gigs.

Like am sure there’s no serious points to draw from this about how in tax terms Jimmy Carr exemplifies how in Britain today there is very clearly one law for the rich and another for the rest of us, that we most certainly aren’t all in this together or that there is clearly a lot of wealth out there not being fairly taxed, which is a shame because doing so would pay for the kind of vital public services that save and change lives.

So yeah, Jimmy Carr, funny fella. And presumably, every other “edgy” comedian is already having words with his or her accountant.

In the meantime, so what could the £168m Jimmy Carr and others actively chose to place ina tax shelter have actually bought if it was taxed fairly i.e. at 50% i.e. £84m? Well £41.5m would buy a brand new Edinburgh secondary school, but is only enough to buy a chunk of a £150m new sick kid’s children’s hospital. Iz zat all? Never mind, am sure us plebs will pick up the rest of the tab.

Oh hang on, actually we’re picking up all of the tab cos we’re PAYE and don’t choose to pay accountants to finesse our finances, facts that to me imply the 1% rich are fucking scum that deserve to be publically spat on then horse raped.

* I wonder if this is an English thing of liking wet, inoffensive, bland, terribly ambitious but dim, smirking no-marks. Yesterday Tom O’Connor, today Rufus Hound, etc.,

Labels:

jimmy carr,

rufus hound,

tax dodging,

tax efficiency

Sunday, 10 June 2012

Augean Stables

So that’s a Spanish bank bail out then. Lovely. Except it reminded me of this blog post written in 2009 (!) called “Are the Spanish banks hiding their losses?” What was/is so good about this post is how the author shows how one of the 2 big Spanish banks appeared to take an overly optimistic stance when it came to declaring losses on its US mortgage book, the implication being its “loss hiding culture” was probably company wide i.e. it applied to its Spanish operations as well.

Old news? Nope because this year it had become increasingly hard to reconcile the Spanish unemployment rate with the much lower rate of mortgages going bad that the Spanish banks were collectively willing to declare. Alongside this were other suspicions about how Spanish banks were artificially propping up house prices, again to minimise their losses. When confronted with this kind of stuff in April, the Santander CEO declared “Anyone raising this problem as one of the issues for the Spanish financial system is saying something stupid.”

There you are then. Except, alongside this you had Bankia restating its annual accounts for 2011 in a way that turned a Eur309m profit into a Eur4.3bn loss before taxes.

To be fair the Spanish government does finally appear to be aware of the credibility issue surrounding Spanish bank accounts, hence independent outsiders have been brought in to establish how much capital the Spanish banks need before the bail out gets doled out. Except, outsiders already audit Spanish banks so they can produce annual accounts; they’re called accountants.

So what makes this lot any different? Err, they’re management consultants as opposed to bankers or accountants, which is kinda confusing. Like are accountants no longer fit to audit banks, are current annual reporting requirements that inadequate, are Big 4 firm Spanish accountants bent? Am sure all of these things will be examined at length and in great detail.

Back in the real world, there are a couple of things to consider. One is the extent to which a blind eye appears to have been turned towards the general dodginess of Spanish bank accounting practices both at a Spanish and at an EU level. Practically, this left the Spanish government playing catch-up, placing sticking plasters here and there as new problems emerged. The consequent Spanish and EU failure to sit down and sort shit out once and for all led to a drip, drip dripping away of confidence and credibility that I’d guess means the bill now in the process of being paid is far bigger than it would have been say 2 years ago (compare/contrast with the last British government's approach of bank recapitalisations and the introduction of an Asset Protection scheme to draw a line under potential, future losses).

Another is how this modifies interpretations of the current situation that focus exclusively on government debt. Spain had a debt fuelled property bubble to be sure, but a private sector led one; the Spanish government was by comparison a global model of fiscal probity. So rather than debt, I reckon the main parallels to draw between Spain, Greece and Italy concern the significant contribution the behaviour of their political and economic elites made to their current woes, be it institutionalised Greek tax dodging, Italy’s general bentness or Spain’s overly optimistic bank accounts. Note how in every case these issues cut across both the public and the private sector. Note also, give or take Berlusconi being got rid of, how bail outs don’t directly address them i.e. the European debacle is going to continue for the foreseeable future with presumably Portugal and Italy next in line.

Labels:

bankia,

credit crunch,

EU,

financial crisis,

Spanish bank bailout

Wednesday, 6 June 2012

Who dat

Watching Paul Krugman bitch slap Jon Moulton on Newsnight was fun. Like for all Jon Moulton, rightly, made his (public) name speaking vast amounts of common sense about Rover as the Phoenix debacle took shape, it turns out he’s a pro-austerity fella and as such deserved all he got. One wee thing that confused me though is the way he keeps getting introduced/described as a venture capitalist, because my understanding is he’s not.

Like calling Moulton a venture capitalist is like calling a dentist a gerontologist. So sure a dentist and a gerontologist are both medical fellas, but they’re ones with very distinctive specialisms/areas of expertise, who do different things and use different tools. Similarly, whereas a venture capitalist typically focuses on early stage businesses and typically, besides commercial savvy, provides technical expertise related to what it is a business does as well as equity, yer man Moulton is better described as a private equity bod, who targets well established concerns e.g. Reader’s Digest, and provides/inflicts generic financial engineering alongside commercial savvy. Plus, his deals typically involve oodles of debt with a cheeky wee bit of equity on the side.

Rather than pedantry, the nomenclature being used matters. A lot. Back before the credit crunch crunched private equity became one of capitalism’s more evil, unacceptable faces, one dominated by multi-millionaires who paid less tax than their cleaners and who couldn’t attend a black tie do without protestors barracking them as they rolled up in their respective Aston Martins, Ferraris, Bentleys etc.,. And while that was here and then, over in the US right now there’s a wee, politicised debate about the worth of private equity prompted by the fact Mitt Romney made his fortune in it.

Ahhh, I’ve answered my question about howcome private equity people are now being called venture capitalists by the mainstream British media haven’t I? It’s a way of involving them in public debate whilst avoiding debate and disassociates them from what was previously said and thought. Plus, venture capital is a much more moral, credible and legitimate activity – the strike rate for venture capital investments is much lower than it is for private equity i.e. venture capital really does involve the risk taking that provides one of the major justifications for economic inequality. Plus, venture capitalists genuinely do help bring new things to the table, Facebook being an obvious example, a media thang that’s in as sharp a contrast with the investment made in Reader’s Digest by Jon Moulton’s company as it’s possible to find. So perhaps rather than be inaccurate the BBC etc., should use a new label in line with how these guys are now being presented, howzabout they call Jon Moulton et all, the bearer’s of God’s golden balls of economic common sense?

Except, getting some accuracy into the chat would also highlight private equity’s current problems (though funnily enough not ones that apply to venture capital to anything like the same degree, which stem from the fact we’re in a credit crunch.

This is because the private equity model and private equity profits are predicated on the ready availability of credit; the more private equity borrows to leverage a deal and the cheaper it borrows, the more profitable it is. Unfortunately, since late 2007/early 2008 there has been a step change in the availability of credit and the terms on which it’s lent. Basically, it’s far harder for private equity investors to buy up a company and make money primarily on the back of swapping expensive equity for cheap credit. Instead, they have to work a damn sight harder and be more creative i.e. they actually have to add value.

Now a couple of things follow on from this. One is what in fucking hell was a high profile private equity boy i.e. a player in an entire industry/asset class predicated on borrowing as much as possible as cheaply as possible, doing arguing against the use of cheap debt to ease the economic misery of tens of thousands of people. Seriously. Like private equity loading a business up with debt so half a dozen people can buy more Tuscan villas is a good thing whereas government borrowing to build necessary infrastructure that also cuts unemployment is bad why exactly? And to borrow Paul Krugman’s chat about how economies differ from households, my liability/debt is your asset i.e. the holes in British bank balance sheets that taxpayers subsequently filled were partly punched into them by private equity boys who made personal fortunes as a result.

The other thing, of course, is that if I was a venture capitalist, “ahem” private equity investor, I’d be smart enough to realise the cheap credit days are gone for the foreseeable future so would be looking elsewhere to make my millions.

I know, if we can’t cut the cost of the debt that’s integral to the private equity business model, lets look at influencing other costs, most obviously labour. And hey presto we’ve just had another “venture capitalist” Adrian Beecroft i.e. no he isn’t he’s a private equity bod who just happens to give money to the Tories, producing a government report recommending changes to employment law geared almost entirely to cutting labour costs in ways that (a) would have a significantly adverse impact on what lots of people earn and (b) would consequently increase the tax credit subsidy employers already receive.

So the view of leading “venture capitalists” is that only private equity should be allowed to borrow big, with the taxpayer taking the risk, and that taxpayers should also hand over even more money than they already do to “venture capitalists” via the tax credit subsidies paid to the recipients of shit wages in the companies they buy so they can get even more Aston Martins, Ferraris, Bentleys etc.,. Alternatively, howzabout spades start getting called spades and private equity, private equity.

A July 24th P.S. - the distinction between Private Equity (was leveraged buyout as a mate minded me) and venture capital clearly matters in the US if not here judging by the attempts now being made by venture capitalists there to disassociate themselves from Mitt - he was private equity not venture capital , geddit! - Romney.

Labels:

adrian beecroft,

private equity,

venture capital

Subscribe to:

Comments (Atom)